Swedish Krona has been under pressure since the Brexit, EURSEK has gained from the lows of 9.2474 levels to the current 9.4776 levels (almost 2.5% within 8-10 days of the outcome of Brexit).

However, today’s inflation data may provide a breather. Following the fall in May the data is likely to record another rise thus providing some relief for Riksbank. After all, its main problem is that inflation has been refusing steadfastly to take off properly.

As a result, the Riksbank has been firm with its expansionary monetary policy and moved first rate hikes further back in time at its meeting last week. Rising inflation rates might allow SEK to appreciate short term but while uncertainty on the markets remains elevated sustainable gains are likely to remain elusive.

Hedging Strategy (EURSEK):

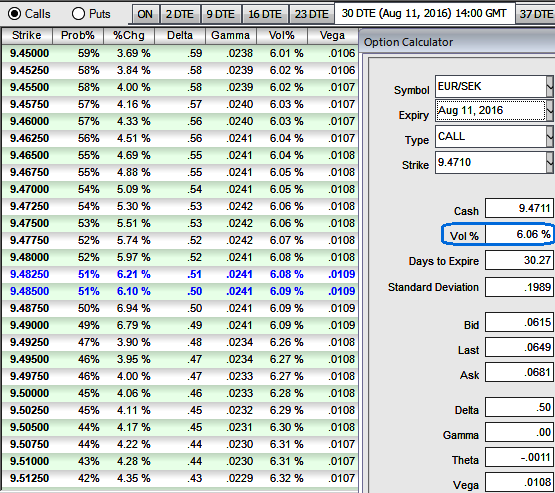

We recommend buying a 2M EUR/SEK ATM put option financed by shorting a 1M EUR/SEK 9.60-9.37 strangle.

We see limited short-term upside potential for the SEK in the near month as 1M EUR/SEK implied volatility is on extremely lower side (see diagram for 1M ATM call is just shy above 6%) and with the theta risk (i.e. time decay) would likely to shrink away as there is downside potential currently. Limited upside risks to EUR/SEK keeps theta becoming cheaper.

We believe Swedish fundamentals have continued to surprise on the upside while the Riksbank has fought off SEK strength via FX intervention threats and further monetary policy easing.

Risky assets have supported the cross via the EUR’s status as a preferred funding currency and the SEK’s sensitivity to global risk sentiment.

We reckon, EUR/SEK likely to slump further but has to remain within range bound (above strikes) in next one month or so, eyeing the 1M shorts strangle to expire out of the money. This keeps our long position with the bought 3M EUR/SEK put option within the money maturity.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025