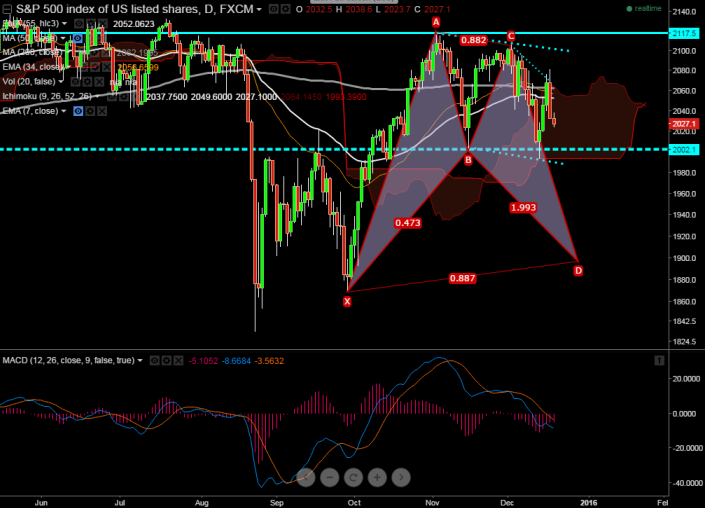

- Harmonic Pattern Formed- Bullish BAT Pattern

- Potential Reversal Zone (PRZ) -2116

- The index has pared its gains after making a high of 2081. It is currently trading around 2028.

- Short term trend is still bearish as long as resistance 2116 holds.

- The minor resistance is around 2040 and break above targets 2062(200 day MA)/2081/ term bullishness only above 2116.

- On the downside major support is around 1990 (cloud bottom) and break below targets 1962/1940/1900.

It is good to sell on rallies around 2070-75 with SL around 2116 for the TP of 1993/1960/1940