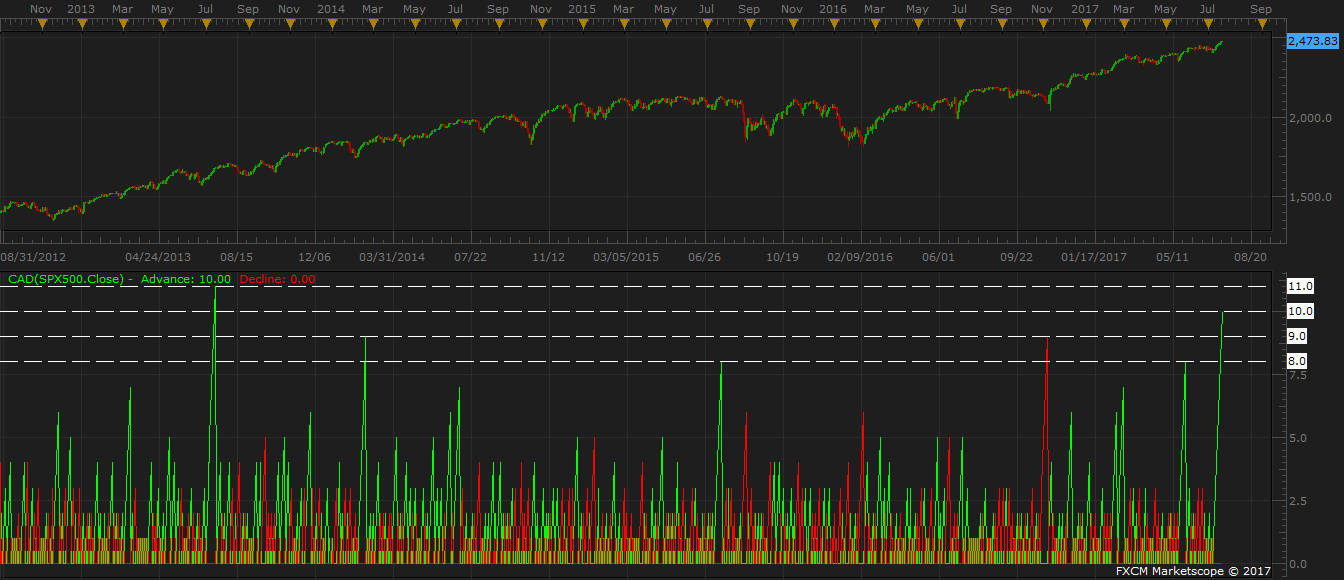

US benchmark stock index, S&P 500 has already risen for 9 consecutive days, longest since February 2014 and it has continued breaking into the uncharted territory of new record highs. The index is currently trading at 2472, up 0.04 percent so far today. If the index rises again today, it will be the longest daily run since July 2013, when the index rose for 11 consecutive days.

Previously, we had expected that S&P might correct to as low as 2390, however, the index found support around 2400 area before earnings season kicked in. Better than expected earnings have pushed the index as well as the US tech index NASDAQ to record highs.

Earnings season:

- So far 6 percent of the companies have reported actual earnings for the Q2, 2017.

- 80 percent of the companies have so far reported EPS above estimates.

- 83 percent of the companies have reported sales reports higher than estimated.

- Sales are 1.7 percent above estimates on aggregate and EPS area 8.2 percent higher than the estimate.

- 100 percent of the tech companies have so far beaten estimates.

- 100 percent of the companies in Materials sector has so far beaten estimates. That figure is 86 percent for Consumer staples, 80 percent for industrials, 75 percent for financials, and 71 percent for consumer discretionary segment.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX