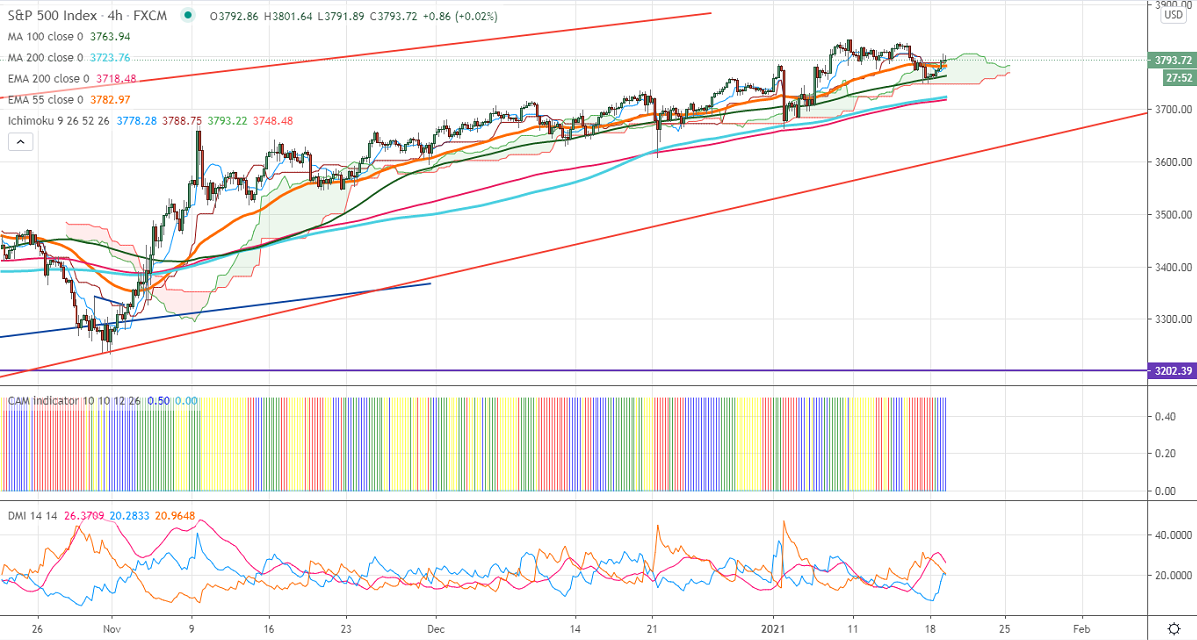

Ichimoku analysis (4-hour chart)

Tenken-Sen- 3788

Kijun-Sen-3788

S&P500 was one of the best performers in the past ten months and surged more than 75% despite the Coronavirus pandemic. The injection of liquidity by major central banks and vaccine by Pfizer and Astra Zeneca has increased demand for riskier assets. The index hits a fresh all-time high of 2832 and is currently trading around 3794.

On the higher side, the near term significant resistance is around 3830 and any jump above will take the index to 3860/3877. The minor resistances to be watched are 3800/3820.

The short term support is at 2844 (daily cloud bottom), any violation below targets 3725/3700/3665.

It is good to sell on rallies around 3798-800 with SL around 3835 for TP of 3665.