Ichimoku analysis (4-Hour chart)

Tenken-Sen- 4476

Kijun-Sen-4486.60

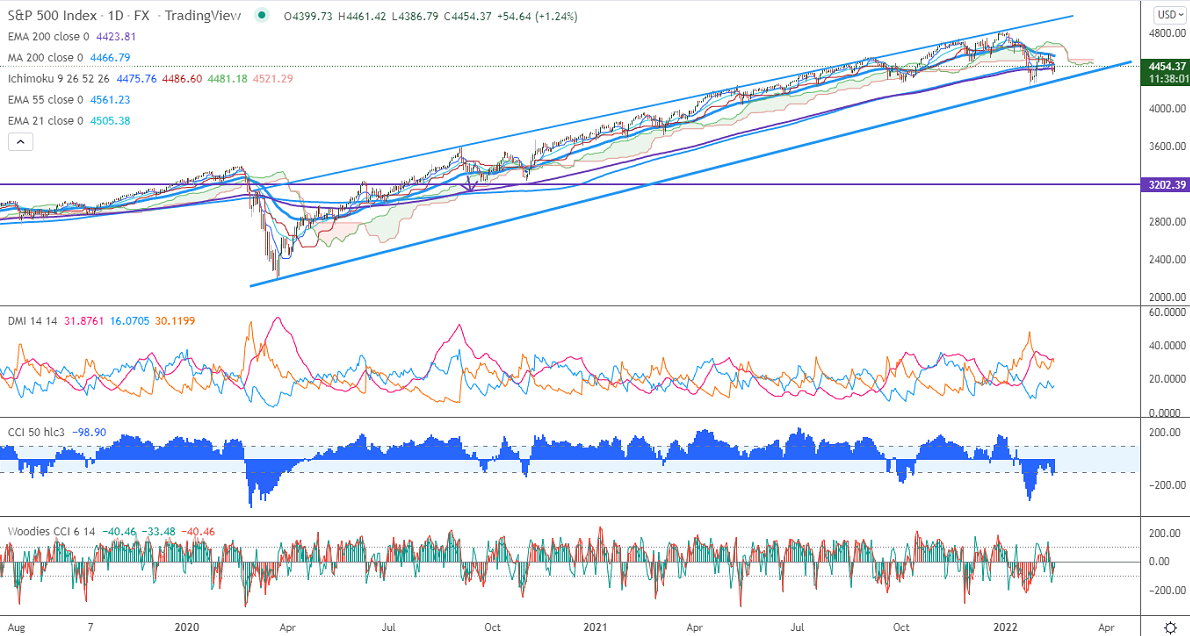

S&P500 regained above 4450 on easing geopolitical tension. According to sources, Russian western and southern armies near Ukraine are returning to bases. The demand for riskier assets surged after positive news. The index was one of the worst performers this year and lost more than 12% in hopes of aggressive rate hikes by the Fed. Markets eye US PPI and Empire State manufacturing index for further direction.

Technically, the index jumped after a minor decline below 200- day EMA (44230. Any daily close below this level confirms further weakness, a dip till 4222 (Jan 24th low)/4000 is possible. On the higher side, the near-term significant resistance is around 4465 and any jump above will take the index to 4500/4597/4756/4820.

It is good to buy on dips around 4400 with SL around 4200 for TP of 4800.