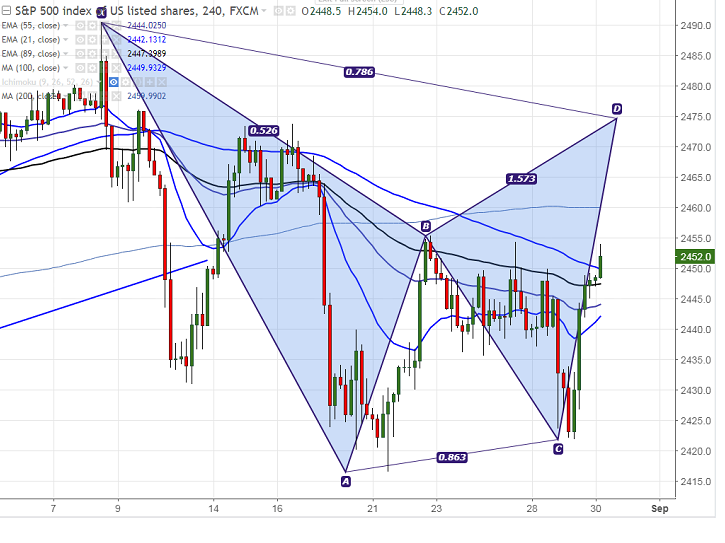

FxWirePro: S&P500 forms potential Bearish Gartley pattern, good to sell on rallies

Wednesday, August 30, 2017 7:55 AM UTC

- Harmonic pattern- Bearish Gartley pattern.

- Potential Reversal Zone (PRZ) – 2490

- S&P500 has formed a temporary bottom around 2422 and jumped sharply from that level. The index jumped till 2454 at the time of writing. It is currently trading around 2452.

- The index nearby resistance is around 2460 (200- 4H MA) and any break above will take the S&P500 till 2473.70 (Aug 16th 2017 high)/2480/2490 (Aug 8th 2017 high). Any further bullish continuation can be seen only above that level.

- On the lower side, major support is around 2400 and any minor trend reversal can be seen only below that level. Any break below will drag the index down till 2346 (May 18th 2017 low).

It is good to sell on rallies around 2470-2475 with SL around 2495 for the TP of 2400