S&P has already been struggling this week, amid weaker growth numbers from around the world and the United States,

- The global measure of Citi's economic surprise index fell below its 2018 low and is now sitting at its lowest level in nearly 5 years.

- South Korea’s manufacturing PMI at 47.2 in February; lowest since June 2015

- Taiwan’s manufacturing PMI at 46.3 in February, the lowest in 39 months.

- China’s manufacturing PMI reported earlier this month, also pointed to a contraction in the manufacturing sector. Chinese service PMI also declined to 51.1, the lowest since October 2019.

- Yesterday, at its monetary policy meeting, European Central Bank (ECB) reduced its growth forecast for 2019, from 1.9 percent to 1.1 percent.

- According to today’s release, the Chinese trade balance in February was just $4.12 billion, as exports slumped 20.7 percent from a year ago. It is the worst number in a year.

And now, the NFP report,

- Though wages rose by 3.3 percent y/y in February, up from January’s 3.2 percent. The headline number declined to just 20,000 compared to 189,000 expected.

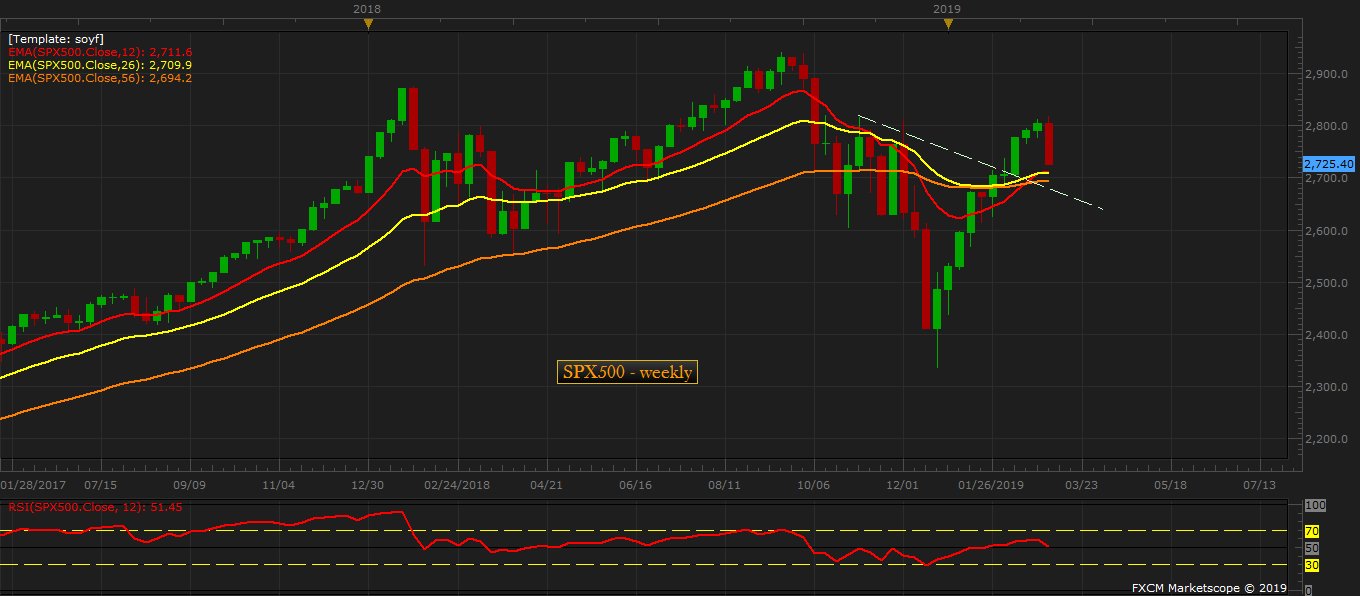

S&P500 is breaking into lower lows as the dismal report signals a slowdown in hiring momentum in the United States. After yesterday’s drop of 0.8 percent, the future is pointing to another 0.8 percent loss in S&P500. SPX500 (CFD of S&P500) is currently at 2725 area.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed