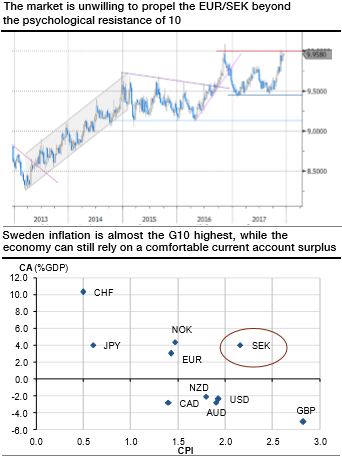

The krone was hurt after the summer due to strong euro appreciation and a particularly dovish Riksbank communication. However, after testing and rejecting horizontal resistance at 10 in November 2016 and November 2017, the EURSEK is likely to have formed a double top (refer above graph).

Like the EURNOK, the pair is now likely to head lower, suggesting that the SEK is going be more robust to euro strength. We are identifying a bearish reversal pattern in USDSEK, containing upside gains.

However, the SEK should not outperform the NOK and we see the NOKSEK bouncing.

Strong real growth and prices rising fast. Sweden recently released strong consumer and manufacturing confidence data, consistent with real growth which was only outperformed by Norway and Canada.

While inflation recently decelerated, only the UK displays a higher CPI. But Sweden has a much more favorable current account in Europe, very close to Norway, while the pound will stay hindered by the biggest deficit. All in all, the growth/inflation/balance global picture is very favorable to Skandis (refer above graph).

Owning USDNOK – EURUSD risk-reversal spreads as hedge overlays on bullish Euro positions is appealing in concept, however, since returns from doing so have historically been anti-correlated to vol spikes without the kind of relentless interim bleed that vol longs are notorious for. Something to consider closer to the FOMC meeting in September perhaps.

The SEK seems to be undervalued at levels around 10 in EURSEK and welcome the correction seen yesterday afternoon caused by central bank governor Stefan Ingves not seeming concerned about the slightly weaker house prices and him not expecting a worrying collapse in prices.

NOKSEK has likely formed a double-bottom just above parity, suggesting that the market is unwilling to go short the cross.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate