At the moment, if you have to observe the intermediate trend of AUDCAD, it seems to be bullish biased but restrained at 1.0134 and long-term trend has been non-directional. The intraday sentiments signal little buying sentiments but the upside potential is capped at 1.0053 as we observed the pair hasn’t currently been able to breach and sustain above this resistance level where prices were rejected in the recent past at the same juncture. But uptrend in the intermediate term can also not to be ruled out.

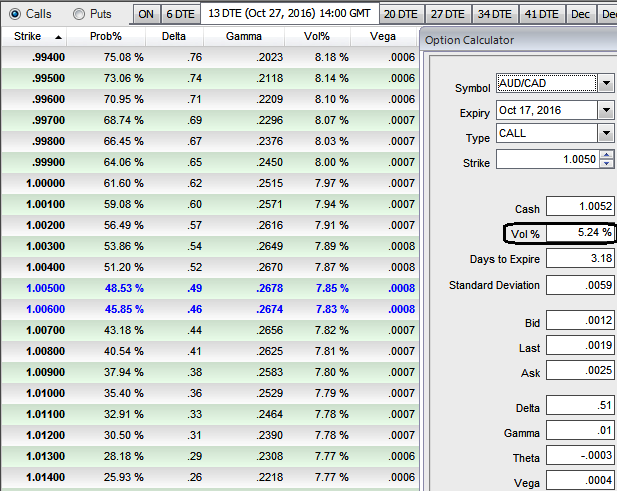

While the spot FX is trading at 1.0040. 1w ATM IVs are creeping up at shy above 5.24%.

Amid this uncertain trend direction, let's suppose that we execute following option trading positions by writing 1w at the money -0.49 delta put and write an at the money +0.51 delta call of same expiry for the net credit.

While going long in 1000 units of spot FX of AUDCAD, the cost of going long in the spot would be negligibly lower than that of above option trades, but considerable. Thereby, we understand that the total premiums received for short option positions would certainly be more than spot FX trades.

Most likely scenario: On expiration, if AUDCAD rallies above the strike price to 1.0134 (resistance for intermediary trend), the 1w short put would expire worthless.

While the short on ATM call expires in the money and the 1000 units should be obligated and exercised, producing a negligible gain.

But including the total premiums received upon entering the trade would render the certain profits; hence, the total net profit stood up to slightly higher than premiums received which is also the maximum profit attainable.

Adverse scenario: Alternatively, when the spot FX price of the pair keeps dipping due to failure swings at resistance, short call expires worthless (premiums on this trade can be pocketed in safely) but the naked short put and spot long position suffer large losses.

The short put is now worth more and needs to be bought back while the long spot position has also lost. But in a case of exercising obligation on puts would be taken care by these spot outrights.

Covered straddles are limited returns, unlimited risk options strategies similar to the writing of covered call. Another way to describe a covered straddle is that it is simply a combination of a covered call write and a naked put write. The major reason why we are advocating this strategy is that the IVs are extremely on the lower side and long term trend is non-directional.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025