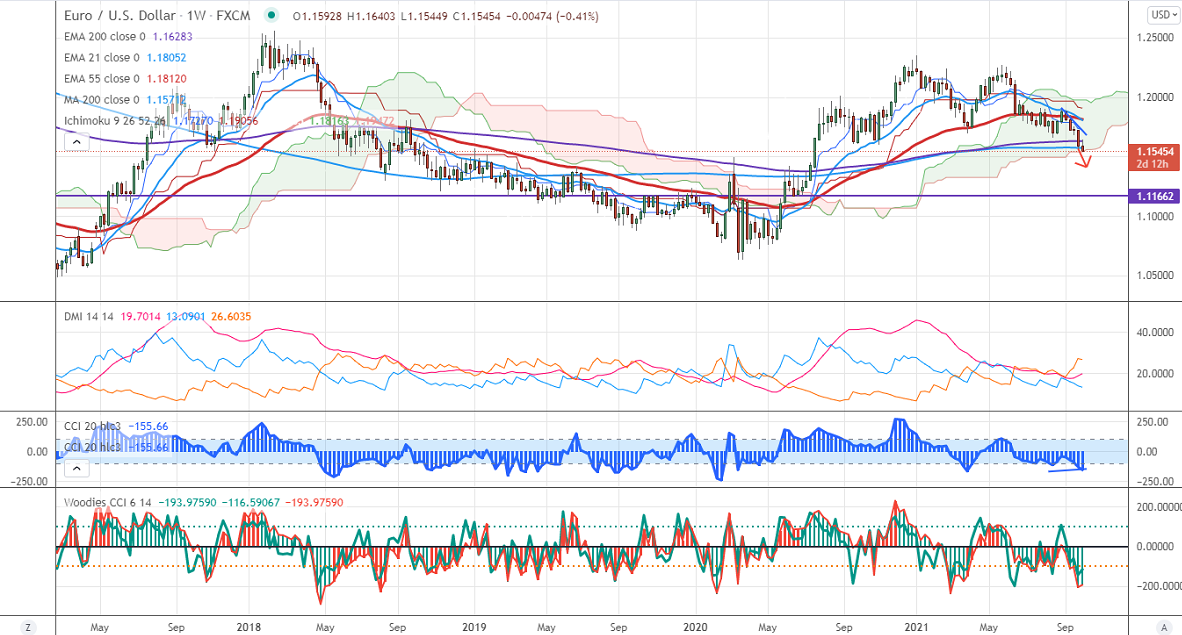

Ichimoku analysis (Weekly chart)

Tenken-Sen- 1.17358

Kijun-Sen- 1.19144

EURUSD hits fresh yearly lows after breaking a 14-month low of 1.15620. The risk-on mood and surge in energy costs are supporting the US dollar at lower levels. The Senate will vote on Wednesday to raise the debt limit. The surge in US treasury yields also pushing the US dollar higher. It hits an intraday low of 1.15513 and is currently trading around 1.15545.

Economic Data-

US ISM services PMI came at 61.9 in September compared to a forecast of 59.90.

Technical:

On the higher side, near-term resistance is around 1.1650 and any convincing breach above will drag the pair to the next level 1.17010/1.1760. The pair's immediate support is at 1.1550, break below targets 1.1500/1.1400.

Indicator (Weekly chart)

Directional movement index – Bearish

It is good to sell on rallies around 1.15725-50 with SL around 1.1640 for TP of 1.14580.