The hope that the NAFTA renegotiations will be concluded successfully over the coming weeks allowed the peso to appreciate further against USD over the past few weeks. The currency pair is now trading below the 18.50 mark. At the America summit next week the US, Canadian and Mexican negotiators will hold further talks. The US seems to distance itself from the tough demands so that a successful conclusion of the negotiations ahead of the Mexican Presidential elections in July has become more likely.

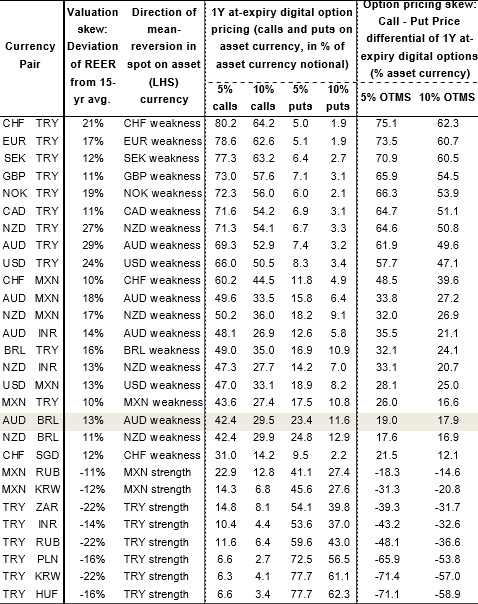

The above nutshell explains that it should not surprise that the most egregious valuation vs. option pricing skewness/asymmetry discrepancies are in high-yielding currencies where favorable forward points create lopsided pricing in the direction of currency calls.

A secondary factor is depressed risk reversals in many currencies that make high-yielding FX spread/digital structures cheaper than normal.

MXN and TRY are the two most popular currencies to own via options. Pairing undervalued and overvalued currencies will invariably create esoteric combinations that are too illiquid to transact in options, but there are relatively mainstream pairs like CHFTRY, EURTRY, USDTRY, CHFMXN and USDMXN in the mix where options can be dealt within reasonable transaction costs.

Our standpoint has been adverse on both MXN and TRY at present, so caution is warranted around jumping headlong into reversal trades. MXN is the relatively better candidate of the two as NAFTA stresses are easing, but there is still a Mexican election event to negotiate before the coast is clear for buying.

For investors more constructive on the peso than us, one option is to start legging into MXN calls now, but wait for the elections to pass before selling MXN puts against them to improve the net carry profile of the structure. From a risk management standpoint, relative certainty on political tail risks after the elections is worth the loss of (over-priced) vol premium as the event rolls off the expiry calendar. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields