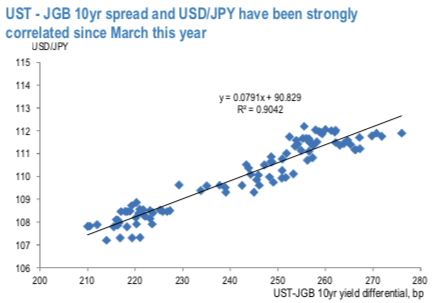

USDJPY has been stuck in the range between 107 and 109 levels. JPY nominal effective exchange rate (JBDNJPY) did not show clear direction during the period. The driver of the USDJPY movement was clear; UST-JGB 10yr yield spread (refer 1st chart).

USDJPY moves about 0.8yen when UST-JGB 10yr yield spread move 10bp. Since the yield spread moved only between 210bp and 227bp, USDJPY fluctuated within a narrow range. The U.S. and Japan rates research team believe the yield spread is unlikely to change at least in Q3, which suggest USDJPY may stay this narrow range in coming months.

Central banks have spurred a search for carry. July ECB/Fed meetings can extend this, but for sustained performance, growth will eventually need to show signs of bottoming out.

This strong correlation between UST-JGB 10y spread and USDJPY probably makes Japanese investors easy to invest in US Treasuries with taking FX risk. When the US yields lower, USDJPY is supposed to decline, but according to our calculation, loss from lower USDJPY in FX position is easily offset by profit from the higher price of US Treasuries as long as current correlation continues. Indeed, estimated FX- unhedged foreign bonds investment by Japanese investors increased substantially in June (refer to 2nd chart).

Shorting USDJPY futures contracts of mid-month tenors have been advocated, on hedging grounds ahead of BoJ and Fed’s monetary policies that are scheduled on 29th and 31st July, we now like to uphold the same positions as the underlying spot FX likely to target southwards below 106 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: JPM

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close