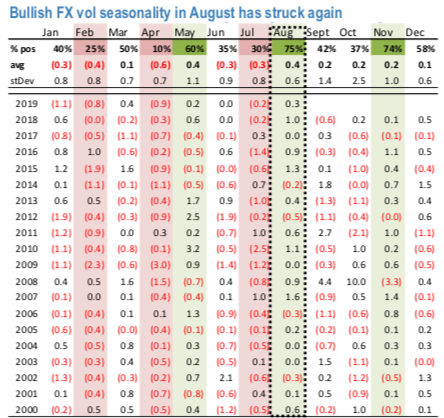

The brutal late-summer bullish seasonality of FX vol (refer 1stchart) has re-asserted itself following an eventful FOMC meeting and a rather more dramatic turn of events on US/China trade towards the fag end of the week. Before being overshadowed by the Presidential tweets that upended any lingering hopes of quiet late summer markets, the “hawkish” Fed cut at the July FOMC could reasonably have been expected to be the marquee event catalyst of the week likely to produce durable market impact over the next few weeks.

A consensus had begun to emerge around soft US exceptionalism and contained dollar strength in the lead-up to the September ECB, as uber-dovish Fed expectations were revised to reflect a more reasonable assessment of concurrent US activity data, and the old strong-US-weak- Europe cyclical/policy divergence narrative revived.

The latest tariff threat from Trump emphatically reinforces this notion of dollar bullishness; the crucial difference for FX volatility is the potential for greater velocity and urgency to dollar rallies than might have been previously anticipated. The net result is a sharp re-pricing higher of front-end implied vols across the board, with the largest increases focused on Asian currencies in the eye of the storm and China-linked high-beta EMs such as ZAR (refer 2ndchart).

In light of the further escalation in the US-China trade conflict, we are revising our USDCNY forecast profile higher. As we have noted in recent research (see China FX focus: Life after 7.00) the risks around a break of 7.00 have arguably never been greater. With tariffs likely to be applied to the remaining set of Chinese exports to the US, upside pressure on USDCNY should only increase, as a weaker currency should be part of the first-order response to such a loss of competitiveness. This has been evident in 2018 and in May of this year after the US raised tariff rates on Chinese exports. Courtesy: JPM

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One