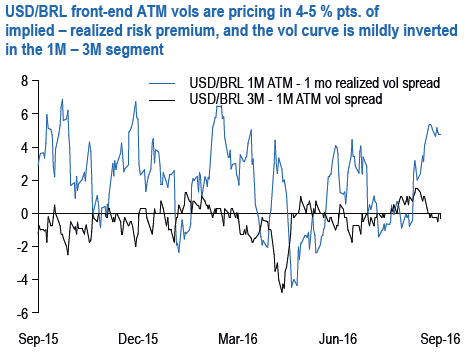

Rare currencies where we do not mind earning the fat vols carry on offer is BRL. Front-end USDBRL vols have popped higher over the past two weeks alongside a bounce in the spot, and are once again packing in sizeable 4-5 % pts. of premium in relation to trialing realized vols (see above chart).

At the same time, the BRL vol curve has mildly inverted in 1M – 3M expiries such that it has become economically viable to sell gamma hedged with vega longs via vega-neutral short 1M vs. long 3M straddle calendar spreads.

The fundamental case for vol selling in BRL rests on both the substantial risk premium on offer and a constructive take on currency macro.

We prefer more cautious calendar approach to short gamma than outright straddles since cash length in BRL is more extended than before after months of portfolio inflows creating risks of whipsaw risk on a technical short USD squeeze.

Directional investors not given to delta-hedging can consider buying calendar spreads of USD call/BRL put one-touch options instead of straddles.

For instance, short 1M vs. long 2M 3.40 strike USD call/BRL put one-touch calendars cost a net premium of 16% on mid (equal notionals/leg).

Assuming unchanged markets in a month’s time, the 1M 3.40 expires worthless and the 2M 3.40 rolls up to 40%, resulting in an acceptable static carry / payout ratio of 2.5 times.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data