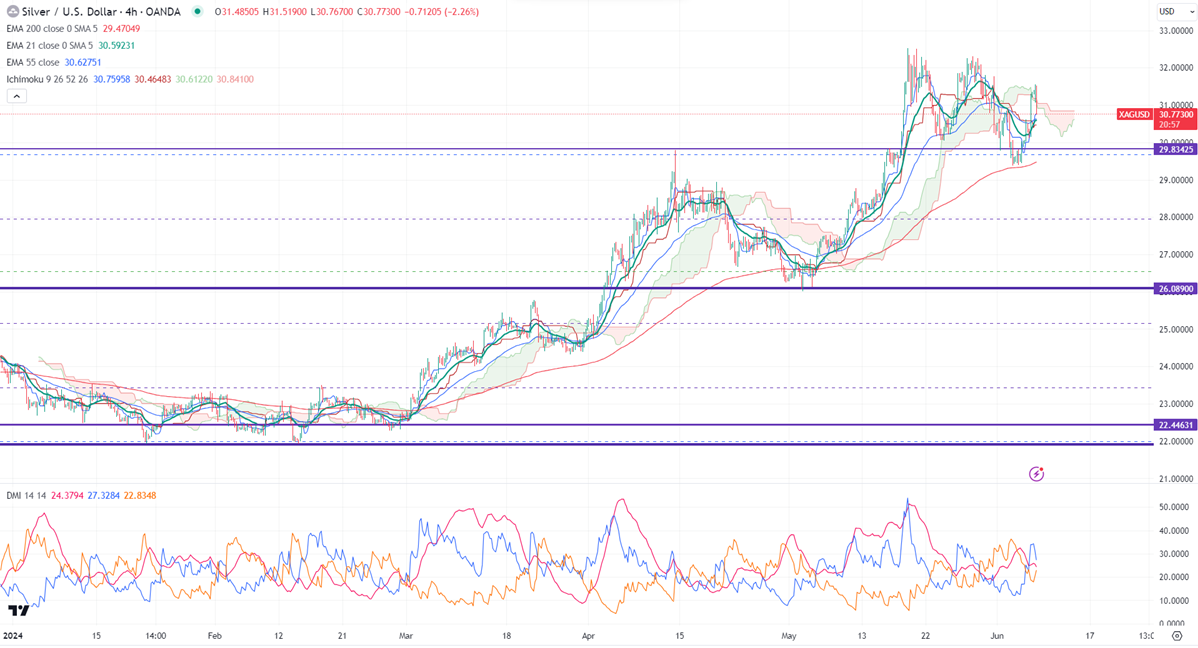

Ichimoku analysis (4-hour chart)

Tenken-Sen- $30.72

Kijun-Sen- $30.46

The Silver traded flat ahead of US NFP data.It hit a high of $31.54 yesterday and is currently trading around $30.84.

The US economy is expected to add 185000 jobs in May from the 175000 the previous month. The unemployment rate holding steady at 3.9% and average hourly earnings to rose 0.30% m/m.

The number of people who have filed for unemployment benefits rose by 8000 to 229000 in the week ended June 1st 2024,

The escalation tension in Middle East also supports Silver at lower levels.

Gold-silver ratio-

Gold/Silver ratio- 77.95. The ratio rebounded from 79.13 to 75.68, well above the historical average of 52. So silver will outperform gold. It is good to buy silver at lower levels compared to gold.

Major trend reversal level -$32.50

It trades above 21 and above 55- EMA, and 200 EMA in the 4-hour chart. The near-term support is around $29.30 and a break below the target of $28.63/$27.90. On the higher side, immediate resistance is around $31.60 and any breach above targets is $32/$32.50.

It is good to buy on dips around $30.50 with SL around $29.50 for TP of 32.50.