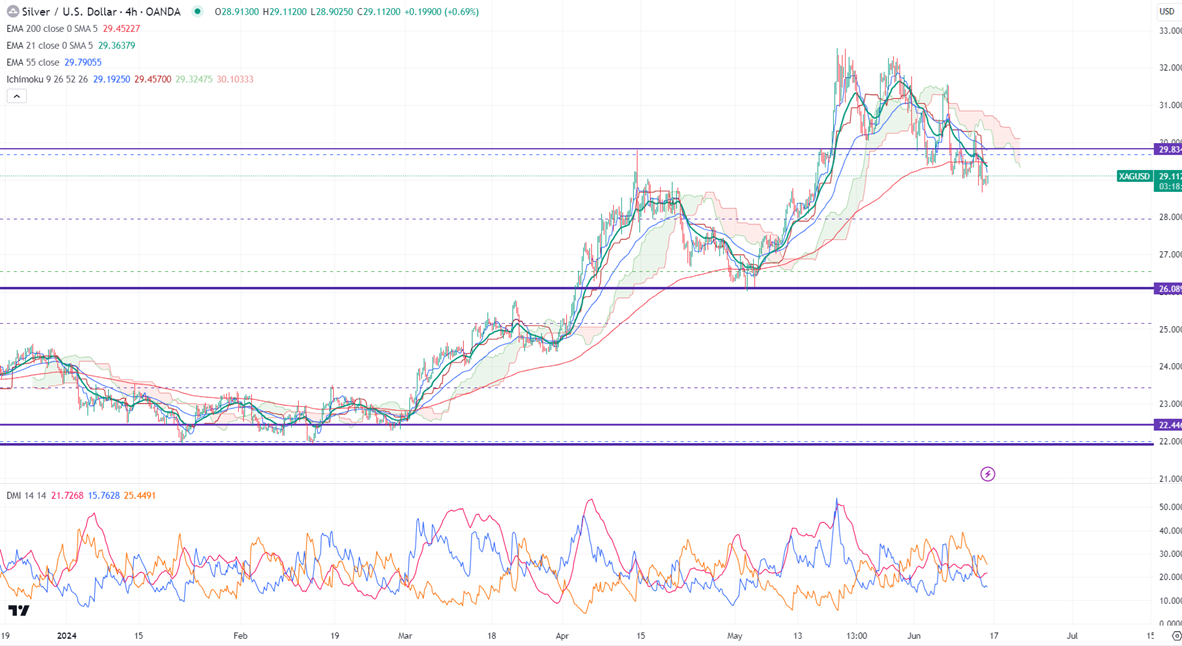

Ichimoku analysis (4-hour chart)

Tenken-Sen- $29.42

Kijun-Sen- $29.45

Silver lost its shine after a minor pullback above $30. It hit a low of $28.65 yesterday and is currently trading around $28.95.

US CPI - weak (positive for Silver)

US PPI - Negative (bullish for Silver)

US Fed - Hawkish rate pause- They hinted at one rate cut this year. (Negative for Silver).

Geopolitical tension in the Middle East and France supports Silver prices at lower levels.

Markets eye US UoM consumer sentiment for further movement.

Gold-silver ratio-

Gold/Silver ratio- 79.50. The silver took support near the 55-day EMA as the Gold/Silver ratio rebounded from 73.11 to 80.10, well above the historical average of 52. So silver will outperform gold. It is good to buy silver at lower levels compared to gold.

Major trend reversal level -$32.50

It trades below 21 and above 55- EMA, and 200 EMA in the 4-hour chart. The near-term support is around $28.60 and a break below the target of $28.30/$27.90/$27. On the higher side, immediate resistance is around $29.50 and any breach above targets is $30/$30.70/$31.50/$32/$32.50.

It is good to sell on rallies around $29.45-50 with SL around $30 for TP at $27.90.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts