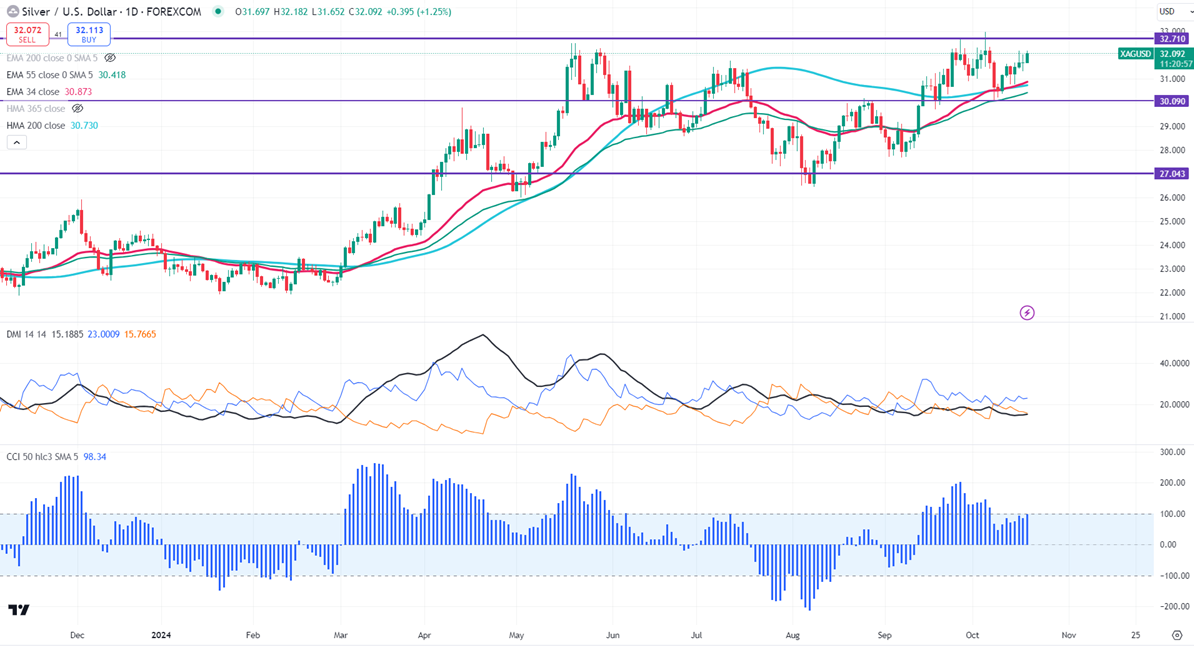

Silver trades higher as demand increases. It hit a high of $32.18 at the time of writing and is currently trading around $32.09.

The encouraging economic data from China bodes well for industrial metals such as silver. In the third quarter of 2024, the Chinese economy grew by 4.6% year-on-year, slightly surpassing forecasts of 4.5% but down from 4.7% in the previous quarter. This marks the slowest growth rate since early 2023, reflecting ongoing issues such as a declining property sector and weak domestic demand. Year-to-date GDP growth stands at 4.8%, falling short of Beijing's 5% target. Meanwhile, industrial production increased by 5.4% in September, exceeding expectations, and retail sales rose by 3.2% year-on-year, outperforming analyst predictions.

Gold-silver ratio-

Gold/Silver ratio-84.78. The gold-silver ratio decreased from 83.45 to 85.26 showing that gold outperformed silver in the past few days. A ratio above 80 often suggests that silver may be a more attractive investment compared to gold.

Major trend reversal level -$33

It trades above 34, 55- EMA and above 200 and 365 Hull EMA in the 4-hour chart. The near-term support is around $31.75 and a break below the target of $31.25/$30.80/$30.40/$30/$29.60/$28.93/$28. On the higher side, immediate resistance is around $32.25, and any breach above targets $32.75/$33.

It is good to buy on dips around $31.75 with SL around $31.25 for a TP of $33.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand