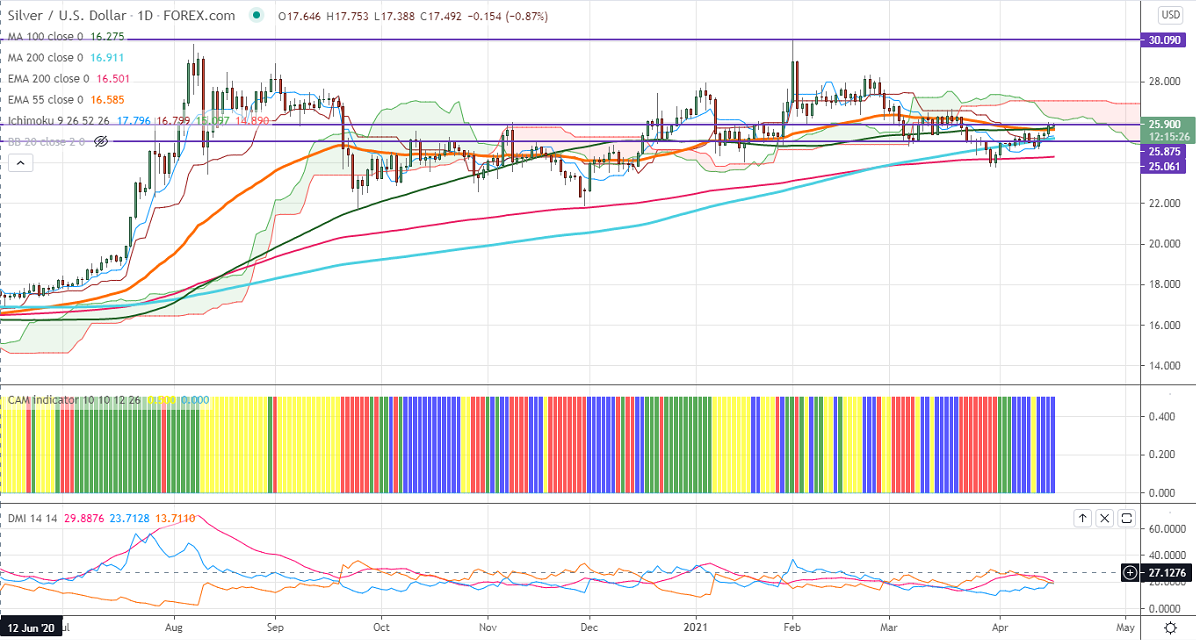

Ichimoku analysis (Daily chart)

Tenken-Sen- $25.30

Kijun-Sen- $25.209

As per our analysis, Silver continues to trade higher for fourth consecutive days. The jump was mainly due to the weak US dollar and minor sell-off in US bond yields. US retail sales data surged to 9.8% in Mar compared to a forecast of 5.8%. The number of people who have filed for unemployment benefits declined to 576k in the previous week compared to an estimate of 703K.

The silver performed well this month and surged more than 9%. With no major economic data today. Markets eye US University of Michigan consumer sentiment. It hits an intraday high of $25.95 and is currently trading around $25.92.

Technically, silver's significant support is around $25.75 (100- day MA), violation below will drag the pair down to $25.48/$25.25/$25. Significant bearishness can be seen only if it breaks below $24.60.The near-term resistance is at $26, any surge past targets of $26.65/$27 is possible.

Indicator (Daily chart)

CAM indicator –Slightly bullish

Directional movement index – Bearish

It is good to buy on dips around $25.45-50 with SL around $25 for TP of $27.