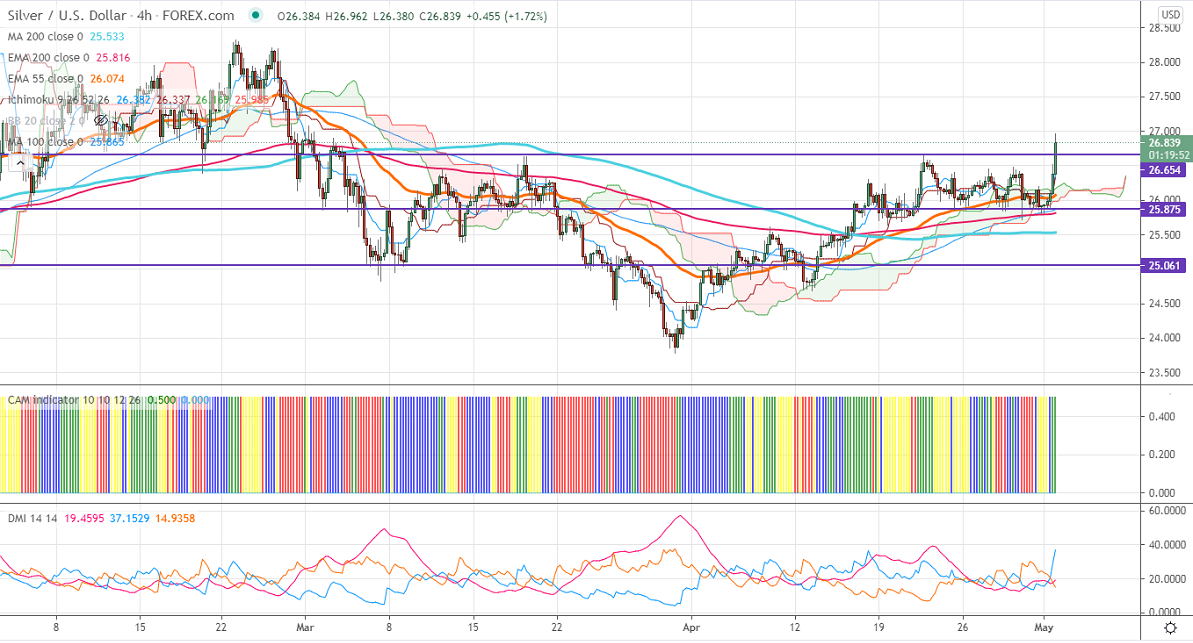

Ichimoku analysis (4-hour chart)

Tenken-Sen- $26.15

Kijun-Sen- $26.11

Silver has recovered sharply and hits a 2-1/2 month high at $26.96.The minor weakness in US bond yield is supporting the price at a lower level. The US 10-year yield lost more than 6.5% in the past two days. The US ISM manufacturing index came at 60.7 for Apr slightly lowered compared to the forecast of 65%. The US dollar index is trading below 91 levels. Any violation below 90.40 confirms trend continuation. Silver was one of the best performers in the past month and surged more than 13%. It hits an intraday high of $26.96 and is currently trading around $26.877.

Technically, silver's significant support is around $26.60, violation below will drag the pair down to $26.20/$25.79/$25.50 Significant bearishness can be seen only if it breaks below $24.60.The near-term resistance is at $27, any surge past targets of $27.67/$28/$28.20 is possible.

Indicator (4-hour chart)

CAM indicator –Bullish

Directional movement index – Bullish

It is good to buy on dips around $26.60-65 with SL around $26.20 for TP of $28.