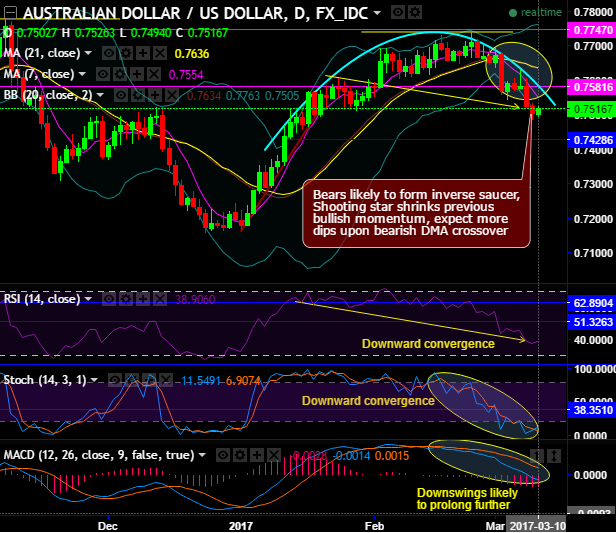

Ever since the bears have managed to reject the previous upswings at stiff resistance at 0.7747 levels, subsequently, we traced out shooting star candles at 0.7679 and 0.7583 levels.

As a result, it is now most likely to form inverse saucer pattern as you could make out more downswings to drag further upon bearish DMA crossover.

On weekly terms, shooting star occurred at 0.7669 levels, this bearish pattern shrinks previous bullish momentum. Consequently, the triple top formation is most likely for now with top 1 at 0.7835, top 2 at 0.7778 and top 3 at 0.7740 levels.

Although shooting star to evidence more slumps but major trend now stuck in range (with upper range at 0.7818 and lower range 0.7160 levels).

But for now, trend is bearish biased as the current prices are attempting to break below 21EMA.

Most importantly, both leading oscillators on both time frames are converging downwards to the prevailing price declines that signals intensified bearish momentum.

While lagging indicators as well signal downtrend to prolong further.

As you could see day trend is heading north but we don’t think the potential is much higher than 0.7554 levels (7DMA), see keeping all these perspectives in mind we advocate boundary binaries that are best suitable for intraday speculation with barriers of 0.7554 and 0.7480 levels.

Alternatively, on hedging grounds, we advocate shorting futures contract of near-month expiries to arrest downside risks towards 0.7421 or even 0.7306 levels cannot be ruled out upon breach of 1st target.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.