NZDJPY momentum has swung to positive, with potential to reach the 76.00-76.50 area. Global risk sentiment has been positive recently (see record US equity prices), hurting the safe-haven yen.

BoJ tightening may be a long way off, but that won’t stop markets from pricing it in, supporting the yen and pushing NZDJPY down below 72.00 by year-end.

OTC Outlook and Options Strategy:

NZDJPY’s trend has been within the tight range of 76.859 – 74.040 levels, but the pair is having more bearish traction and expected to depreciate upto 72.5 levels by 3Q’19 as RBNZ outlook remains on hold throughout 2018.

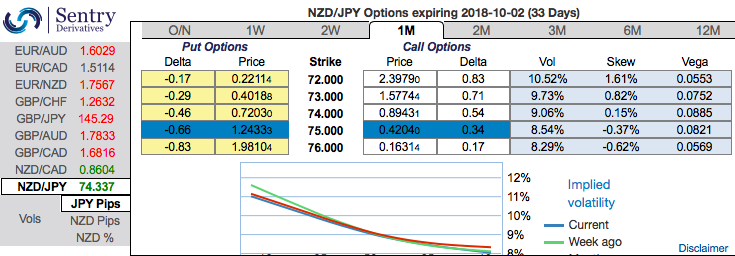

To substantiate this bearish stance, the 1m positively skewed implied volatility indicates the hedging sentiments for the lingering bearish risks. Bids are for OTM puts upto 72.00 levels.

Implied volatilities of this pair is trending at 8.29% and 10.52% of 1m tenors respectively. Lower IVs are conducive for options writers and higher IVs are good for option holders.

As a result, we construct suitable options strategy favoring slightly on bearish side. Initiate 2 lots of 2m longs in (1%) in the money -0.79 delta put options, simultaneously, short 1 lot of (1%) out of the money put options of the narrowed expiry (preferably 2w tenors), the strategy is executed at net debit.

Deep in the money call with a very strong delta will move in tandem with the underlying. The short side likely to reduce cost of hedging with time decay advantage on short leg, while delta longs likely to arrest potential bearish risks.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -24 levels (which is bearish), while hourly JPY spot index was at -100 (bearish) while articulating (at 10:52 GMT). For more details on the index, please refer below weblink:

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different