GBP’s performance in recent months was noticeable than analysts had anticipated on a blend of less immediate tail risk from Brexit (following outline political agreement in December over a stand-still transition once the UK leaves the EU next March until end-2020) and a more constructive central scenario for the economy and monetary policy. Of the two, a reduction in the Brexit risk premium appears to have been the more significant.

Nevertheless, the modest acceleration in UK growth to around 2% doubtless contributed to the reversal of speculative positioning in GBP from heavily short to heavily long (more so CTAs than macro investors we believe) as it led to a firming up of UK rate expectations (one and a halfhikes are now priced for the end of 2018, three and a half by end-2020) and the promotion of GBP to the vanguard of currencies where central banks are in the early stages of policy normalization.

Impressions though can be misleading, certainly as far as Brexit is concerned.

In our view, the medium-term prospects for Brexit and by extension GBP remain in a state of uncertain political flux. Investors may have assumed that a transition was a done deal but there are substantive aspects of the transition (the Irish border, migration) on which the UK and EU have not been able to agree (because they are so politically charged for a fragile Conservative government) and which prompted the EU’s chief negotiator to warn last week that a transition was not a given. A non-negotiated cliff-edge Brexit may be a very low probability event but that probability is not zero.

OTC indications (GBPUSD):

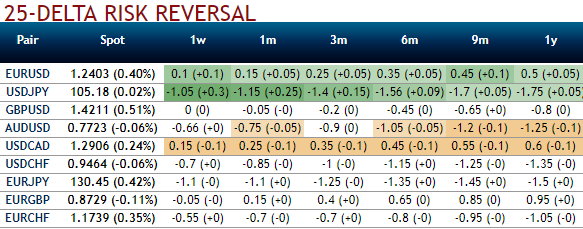

Let’s glance on sensitivity tool, there is no shift in risks reversals of GBP crosses in both shorter and longer tenors that indicates hedgers are factoring in above stated driving forces to their exposures, while the momentary bullish risks are seen in underlying spot FX prices, while long-term bearish hedging sentiments remain intact.

Positively skewed IVs of 2m tenors have been well balanced that signifies the hedging interests on both OTM put/call strikes that means the ATM instruments have a higher likelihood of expiring in-the-money, while balanced hedging sentiments on either side in comparatively shorter tenors are favorable to both call and put options holders’ advantages.

Whereas the 6m skews have still been indicating bearish risks, this stance is substantiated by the bearish neutral risk reversals that indicate hedgers still bid for downside risks. ATM IVs are still stuck between 8.10-8.30% ranges for 3-6m tenors.

Currency Strength Index: FxWirePro's hourly GBP spot index has turned to -98 (which is bearish), while hourly USD spot index was creeping up at shy above -62 (bearish) while articulating (at 08:29 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data