PLN: We moved MW on euro area weakness. We recently stopped out of our bullish PLN position following disappointing euro area business surveys and further EURUSD downside but remained hedged using below options strategies.

Fundamentally, we remain constructive, believing the currency is now relatively weak compared to the resilient domestic data.

However, the scope for meaningful appreciation will remain limited until EURUSD turns higher, in our view.

CZK: Our favoured OW, holding short in USDCZK and EURCZK. We reckon that CZK remains the strongest reflation trade within CE4.

The bullish stances are driven by our expectation that CNB will surprise more hawkish and hike twice this year and by a strong basic balance of 2.6% of GDP.

The currency screens 5% cheap in our BEER model and 9% cheap in our FEER model. Data momentum is starting to turn, with downside surprises in inflation now mostly behind us. Courtesy: JPM

Derivatives Hedging Strategies:

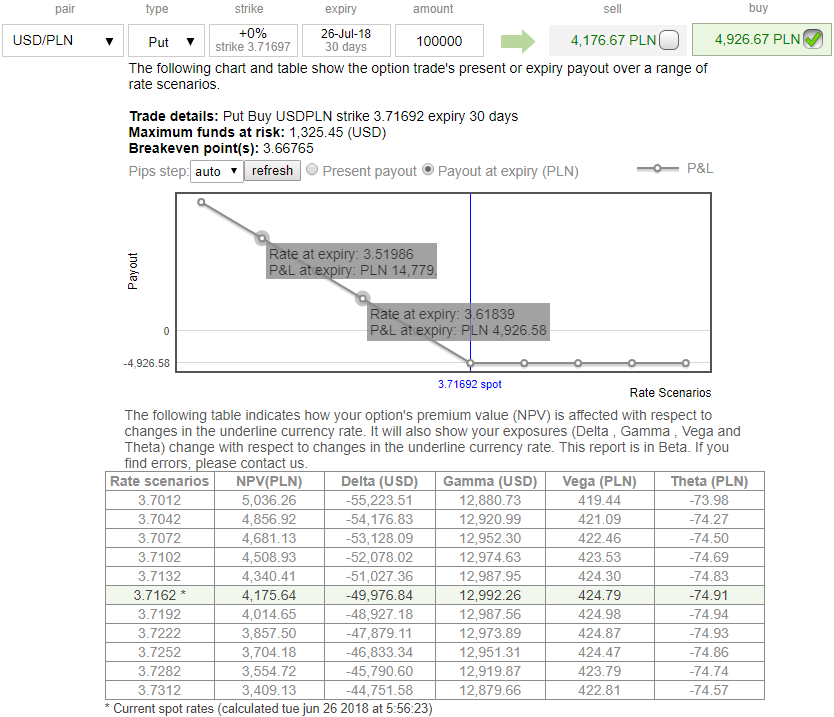

On hedging grounds, we advocate initiating longs in USDPLN and USDCZK at-the-money -0.49 delta put options of 1m expiries with a view to arresting potential bearish risks (50:50 notional, at spot reference: 3.7199 and 22.1863 levels). Delta measures the change of an option's premium with respect to changes in the currency pair exchange rate. Another way to reckon of Delta is as if it's your outright spot exposure.

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at -35 levels (which is bearish), while articulating (at 13:03 GMT).

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell