Asymmetric sterling risk: GBPUSD after flitting above 1.35 for the first time since the Brexit vote, cable is retracing lower, following the EURUSD consolidation. The lower spot provides the opportunity to buy distant OTM calls, as the GBP risk is now getting very asymmetric.

Prices remain under pressure, with the 1.30 psychological region and 1.2950 channel support below there already looming. US employment and the USD is likely to be the driver in the most part today, but a move back through 1.32 is needed to check this current trend lower and suggest a broader correction. While under, we still target a move towards 1.28, with the risks rising for a deeper move through there.

Long term, our studies suggest the bear trend that started back in 2007 at 2.1160 is in its last phase. Recent price action increases the chance that 1.1490 was a major long-term low.

In addition to this, several fundamental factors to minimize the bearish case in the medium term but could still fuel massive upside:

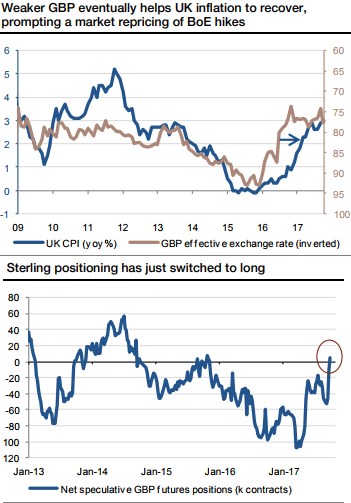

Monetary policy: The BoE is showing its hawkish teeth on the back of higher inflation prints (the weaker currency helped massively – refer above graph). This prompted the GBP short rates market to re-price BoE hikes quite aggressively.

Slower Brexit negotiations: Theresa May’s 22 September speech sounded optimistic, proposed a two-year transition period for Brexit, and pushed to find a creative solution to the trade negotiations. The market would be reassured in the meantime if the UK economy stands firm, preserving cable’s positive correlation with the strengthening euro.

Is this an end of shorts: According to CFTC data, the market has been net short sterling futures for almost all of the last three years but switched to a long last week (refer above graph).

Positive tail risk: The minimal but existing probability that Brexit does not happen or is implemented in a way that convinces the market that it will do no harm at all justifies trading such a scenario via cheap options.

We fundamentally view asymmetric odds in favor of the topside case, and this highlights the current cheapness of GBPUSD OTM calls. Courtesy: SG

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary