Canadian central bank (BoC) is scheduled for their monetary policy next week on September 4th. A resurgence of global fears from weak cyclicals and renewed trade war risk reversed most of CAD’s second-quarter strength against the dollar. USDCAD has rebounded 2.5% from mid-July lows of just above 1.30 back above 1.33, on the back of broad dollar strength as global trade war risks re-intensified and global recession fears rose.

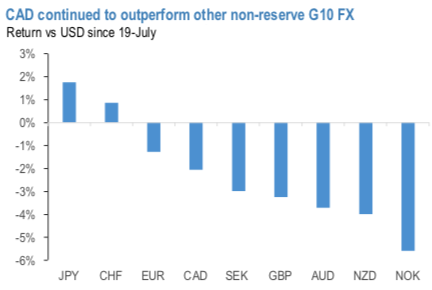

However, what has not reversed yet is CAD’s ongoing outperformance against all its G10 high-beta and most EM peers (refer 1st chart).

The drivers of this outperformance will likely fade in the coming months. FX outperformance in recent months has been consistent with unexpectedly strong growth, with our economist having raised its 2Q GDP tracking to 3.2%, SAAR. But we continue to view this strength as being temporary. Certainly, the rebound in activity in Alberta on account of easing of oil production curbs will normalize, especially given the softer tone in global oil prices. The other hitherto outperforming sector, exports (driven by US demand), which we had earlier flagged was likely unsustainable and vulnerable to payback, looks to have softened exiting 2Q and together with a recent weak employment report, our 3Q nowcaster is suggesting a sharp deceleration in the current quarter to a 0.8% pace.

But the BoC's reaction function, especially relative to the Fed, will remains one of the biggest uncertainties around CAD’s relative performance. CAD 2y OIS has declined 11bps in the past month, and now is pricing in up to three cuts by end-2020, starting in December. The economists are forecasting the BoC to deliver insurance cuts in Oct and Dec, although uncertainty around this is higher for BoC than perhaps elsewhere where central bank rate cuts are being priced in.

The extent and duration of further CAD strength will depend in-part on the durability of recent Canadian macro strength and to what extent BoC follows the Fed in cutting.

With the recent collapse in US-CA rate spreads, there is probably concern that CAD is liable to appreciate should the BoC hold indefinitely, which would likely exacerbate what is an otherwise softening domestic economy; we note that the BoC has demonstrated explicit sensitivity to the currency in the past, and is likely to be cognizant of it now. So while the BoC has shown restraint relative to some of its G10 peers thus far in 2019, a BoC cut in the near future is not implausible as global easing persists – JPM forecasts a cut in October.

Thus in this way, we are expecting that BoC will be driven by some competitive easing and currency concerns, not necessarily generally in a global context, but certainly bilaterally vis-à-vis the Fed and the USD.

OTC Updates: At spot reference: 1.3305 level while articulating, positively skewed IVs of 3m tenors are indicating upside risks with OTM bids up to 1.35 level. While bullish neutral risk reversal numbers substantiate this bullish stance and indicate both mild downswings in the near-terms and the major uptrend. Courtesy: Sentrix & JPM

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures