EUR strength has roughly evenly been balanced. EUR benefitted from strong sentiment indicators as well as speculation that the ECB would surprise on the hawkish side, after all, tomorrow (refer option pricing in O/N ECB event risks). So far the view had been dominating that the central bank would take an extremely cautious approach when it comes to exiting from its expansionary monetary policy, as inflation is currently still below target and as it wants to avoid stronger euro appreciation. The solid economic data from the eurozone has clearly given rise to some doubt about this view amongst some market participants after all.

On the flip side, BoE expectations have come under pressure this from a combination of lacklustre growth data releases (annual growth in retails sales is now close to 1% compared to +4% when the BoE eased policy last year) together with a stream of commentary from MPC members that reveals a greater range of opinion about the timing of any monetary tightening. Odds on a November hike have dipped but at 80% still, mean there’s a clear negative asymmetry in how GBP will react to the last few important data releases before the November MPC as well as additional BoE commentary. The focus next week is firmly on the 3Q GDP release that is expected to show the economy languishing at a 1.2-1.3% SAAR growth rate.

It’s important to recognize that a less assertive BoE outlook is not the only factor weighing on GBP. In particular, the GBP TWI has now given back 80% of the gains it made following the hawkish September MPC whereas the rate market has retraced by less than a third (based on the Dec 19 short-sterling contract). This disconnect might suggest that GBP is over-reacting; in our view, however, it simply reflects the additional leverage of GBP to the lack of progress in the Brexit talks and the increased risk of an accidental no deal.

The substance of the EU Council's summit conclusions on Brexit –that the EU would begin preparatory internal discussions on trade and transition, but further progress would be needed on 'phase one' issues for those talks to include the UK –has been clear for at least a week or so.

While we expect talks on a transition deal to begin after the December summit, the atmosphere around the negotiations will remain very uncomfortable in the interim and a probable source of intermittent friction for GBP.

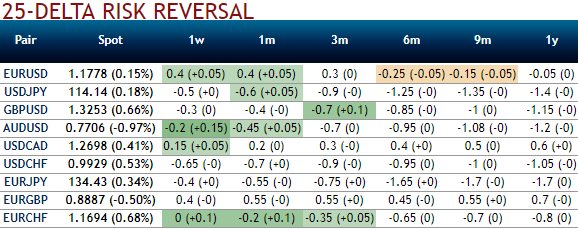

Elsewhere, EURGBP risk reversals still pop up bullish neutral numbers to signal the hedging sentiments for upside risks, while IV skews have also been stretched to OTM call strikes.

Hence, we reckon that a long in 1m 0.8880 - 0.9150 EURGBP call spread would likely arrest FX risks optimally. Marked at 81.6bp.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 78 levels (which is bullish), while hourly GBP spot index was at shy above 86 (bullish) at the time of articulating (at 07:15 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025