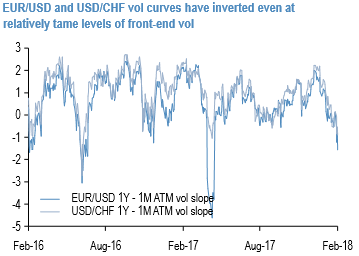

EURUSD and USDCHF 6M-1Y 35D USD call vols: The belly of G7 vol curves is good value to own in our view since they have lagged the rally in shorter-expiries, and should find buying support from value hunters as relatively cheap, positive slide vega plays. Vol curves have atypically inverted at tame levels of front-end vol (refer above chart), but are unlikely to mechanically mean-revert to their usual upward sloping shape if the mean reversion pull on vol levels is higher.

Bull steepening of vol curves led by a rally in longer-expiry vol is possible in theory but is rare in practice absent a regime-change in vega demand that looks unlikely in a still constructive phase of the global business cycle. Instead, a flatter-for longer regime for vol curves seems to us to be the path of least resistance, reminiscent of the early days of ECB QE in 2015 when directional demand for EUR puts kept the vol curve inverted for a good 7-8 month stretch.

EURUSD, and to a lesser extent proxies such as CHF and NOK are among the better value 3M3Mforward volatility longs among USD pairs (refer above chart), meaning that outright vega is best purchased in the 6M-1Y part of the vol curve; we prefer 30-35D USD call strikes that are the trough of the vol surface, especially in CHF where the outsized bid for USD puts on skews renders the USD calls particularly cheap for an RV and smile theta standpoint.

Low-beta USD plays in Asian FX – USDSGD and USDTWD–are also worth owning on similar grounds, the added kicker being that the trend decline in USD/Asia over the past year has likely built up a decent stock of spec longs whose de-risking can lift volatility in these pairs.

Currency Strength Index: FxWirePro's hourly USD spot index has turned into 83 (which is bullish ahead of today’s FOMC meeting minutes), while hourly EUR spot index was at shy above -48 (bearish) while articulating (at 11:49 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?