The toxic blend of a stimulating backdrop for EM, a weak domestic growth narrative, still high economic vulnerabilities, and disruptive politics are a remedy for a period of extended underperformance by the ZAR.

South Africa’s tight economic links to China (10% of total exports, declining but still the highest in EMEA) and high correlation to the commodity complex mean that the rand remains a good proxy for China originated global turbulence.

South Africa posted a higher-than-expected trade surplus of ZAR 18.7 billion in May of 2016 from a downwardly revised deficit of ZAR 0.12 billion in the previous month. It was the highest trade surplus in 19 years.

Although technically USDZAR has shown weakness, we look ahead for fundamental stabilities as the frequently changing finance ministers likely worried investors overexposed to the local bond market. We, therefore, reached USD/ZAR levels we have forecasted for the end of Q2' 2016 at around 15.50 range.

We believe the dust may settle now but would maintain a bearish bias because headline inflation may increase in the near future on seasonality and the current account deficit remains a concern.

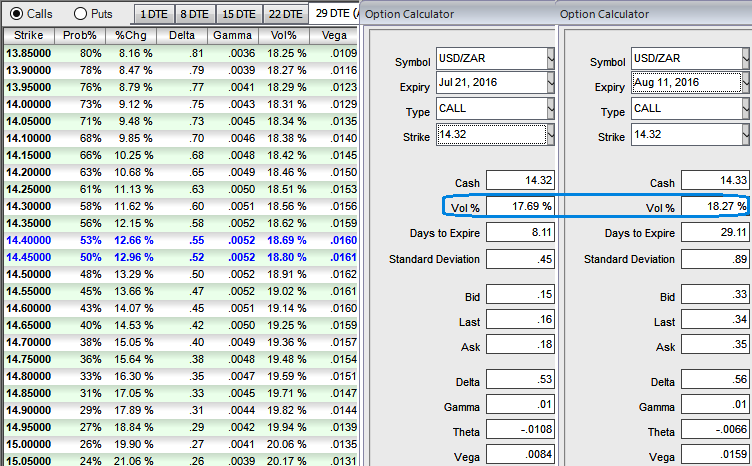

As we want to gain from the short-term appreciation in ZAR and to favour the major uptrend, the recommendation would be the diagonal credit call spreads (DCCS) momentary upside pressures and dubious eyes on the continuation of the long-term uptrend.

Hence, during higher implied volatility times as shown in the IV nutshell, going long in 3M OTM delta call while shorting 2W ATM call with positive thetas for time decay advantage of shorter tenors is the suitable positional strategy for this pair.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?