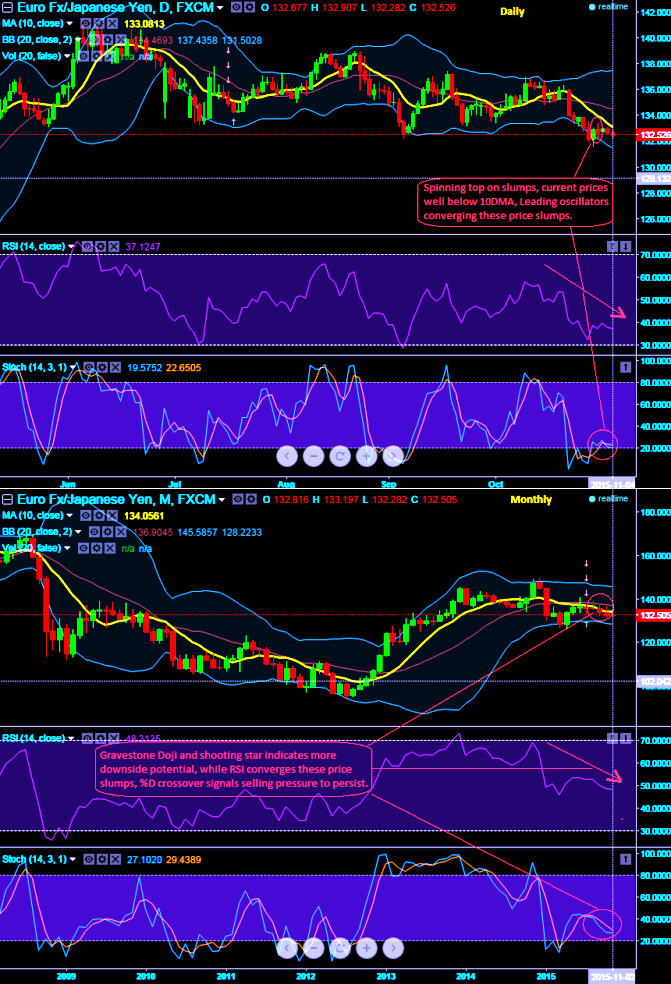

EUR/JPY is boiling up with lots of bearish candles, such as bearish spinning top at 132.700 levels on daily chart. So, traders must wait and see the next price movement. In an uptrend, if a bullish candle forms after the Spinning Top pattern at a support level, it could be used as an entry point.

Considering previous immediate downtrend, bearish candle forms followed by this Spinning Top at 132.700 resistance level, hence it could be used as an exit point.

Gravestone Doji and candle resembling a shooting star on monthly occurred at 135.870 and 132.700 respectively.

It's advisable to use a combination of patterns and indicators to determine your trading strategy.

As a result, these bearish patterns signal more downside potential upto 132.153 levels.

Currently, RSI (14) trending near 37.1247 levels with downward convergence with dipping prices.

Although the there is no sign of either overbought or oversold situation, it alarms bears trying to take over the declining rallies as the slow stochastic noises with %D line cross over around 30 levels on weekly (current %D line flashes at 29.4389).

FxWirePro: Spinning top, Doji patterns signal EUR/JPY weakness - more downside potential upto 132 regions

Wednesday, November 4, 2015 10:16 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings