Growing risks of a trade war between the US and China continue to cast a cloud over global risk sentiment. Asian equity markets have continued to remain under pressure, although some indices have rebounded from their overnight lows.

The FX markets navigated two major events over the past week that left the broad dollar with no more directional clarity than before. The March FOMC under new Fed Chair Powell raised rates as widely anticipated and forecast an additional one-and-a-half rate hikes by the end of 2020, but any hawkish fallout for the dollar was contained by and the back-loaded nature of projected rate increases and only a marginal upward revision to the implied neutral real rate relative to the December’17 SEP.

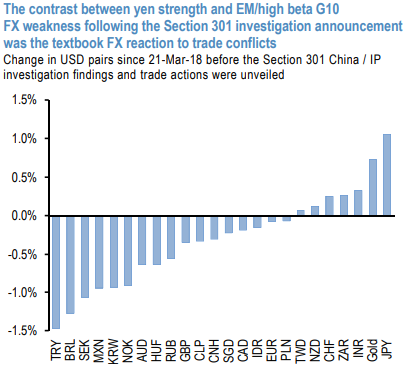

Any designs of re-loading USD-funded carry trades on this relatively benign FOMC outcome, especially given the recent spate of soft-side US inflation prints that had allayed fears of a behind-the-curve Fed, were however frustrated by the announcement of US trade actions following the findings of the Section 301 China/IP investigation that hit equities harder than anticipated.

The 3%+ tumble in SPX after the release led to predictably sharp rallies in JPY and gold and declines in EM and high-beta G10 (refer above chart), and validated our trade protectionism template of decoupling between reserve and non-reserve FX that we have frequently cited.

The trades portfolio has run relatively light on risk in recent weeks, with a slight defensive lean predicated on navigating the uncertainty of potentially disruptive US trade policy. This has helped sidestep head-fakes in risk markets such as that following benign US CPI but has also missed participating in the extension of the yen rally after taking profits on AUDJPY shorts (in hindsight) too early around the VIX shock. Having been sidelined in the yen since then in anticipation of a seasonal uptick in unhedged Japanese outflows in the new fiscal year, we are cautious about chasing USDJPY lower from current levels, especially without the tailwind of broader dollar weakness.

Long reserve FX exposure is instead focused in two of the relative laggards – EUR and CHF – via longs in EUR/antipodean crosses and a short in USDCHF that eked out only workmanlike gains over the past week but offer potentially more durable returns on divergent monetary policy cycles even if trade tensions ebb.

The recent cooling in European dataflow is admittedly a risk to these trades, but one that still bears watching rather than acting upon in our view given the strong absolute level of activity. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure