Bearish EURUSD scenarios:

1) The economy bottoms only very gradually, failing to reach 1.5% growth by mid-year,

2) Trump threatens Euro car imports with tariffs following the 232 reports into the industry.

3) Further escalation in US-China trade conflict that deals collateral damage to the Euro economy.

Bullish EURUSD scenarios:

1) Fed definitively ends the hiking cycle but with European growth back at 1.5-2.0% (so more 2006 than 2000;

2) The definitive resolution to US-China trade conflict;

3) The continued strong CB demand for EUR, 4) More mainstream center-right Italian govt if there are early elections.

EURUSD prices are already sensing upside traction (the recent highs – 1.1306) but quickly rejected that bullish move. The decline has been impulsive in nature as we head into the ECB and as such suggests the rebound from 1.1107 is just another correction. Technically, any decline through 1.1220/1.1190 pivot support would support that outlook. If we can hold that support and rally back through 1.1315 it would re-ignite positive momentum.

On a broader perspective, the prices are within our 1.12-1.08 basing region. We still have little evidence of a major base at this stage, but continue to monitor closely. A rally through 1.1315 would be an early sign of potential move back towards the 1.1750-1.1850 key range highs. Further stepping stone resistance levels lying at 1.1450 and 1.1570 ahead of the range highs.

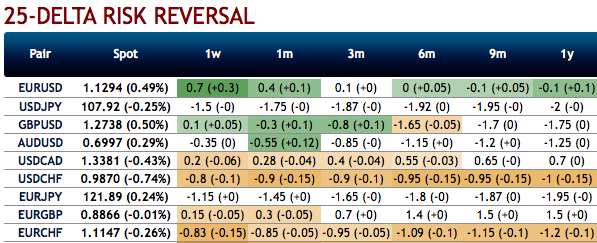

Most importantly, the FX OTC hedging markets are also suggesting the same thing, the IVs and risk reversals of the short tenors indicate interim rallies but the major bearish hedging sentiment remain intact. You could make out the highest OTC activities for EURUSD on ECB monetary policy statement.

Volatility traders perceptibly expect only about what is likely to and what actually turns out. As you could observe the above nutshell, 3m positively skewed IVs are stretched on either side (equal interest in both OTM call and OTM puts) that signifies hedging sentiments for both upside and downside risks.

To substantiate these indications, a positive shift in short-term and bearish neutral RRs (risk reversals) across long-term tenors, which is in line with the above-stated bearish scenarios.

All these indications coupled with the fundamental news and the underlying scenarios are attractively appealing ITM put holders. Contemplating all these factors, we advocate below options strategy.

Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, write (1%) out of the money put option of 2w tenors.

Alternatively, the dubious bulls but with hedging grounds, one can also deploy 3m 1% in the money puts with attractive delta. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.Courtesy: Sentrix, JPM & Saxo

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 41 levels (which is mildly bullish), while hourly USD spot index was at -53 (bearish) while articulating (at 08:14 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure