Today the South African finance minister presents the budget for the fiscal year 2019/2020. Convincing the markets will not be an easy task. After all, the budget deficit is around 4% of GDP and the government debt is just under 60% of GDP.

While the economy is only recovering slowly, the government must put its finances in order. The debacle surrounding the highly indebted state power producer is making the whole thing even more difficult. Controlled and rotating power outages have been taking place again for several weeks now, which in turn has increased concerns about the economy.

In this context, the market is hoping for statements from the government today on how it intends to deal with this problem. As said before, not an easy task. We see the risk that the government will not be able to deliver enough, hence the downside trend of the rand that started at the beginning of this month is likely to continue.

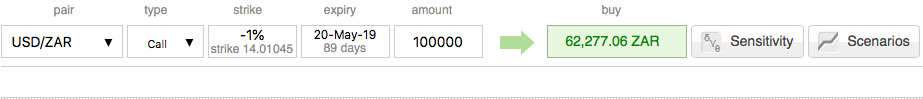

Trading tips: We advocated 3m USDZAR (1%) in the money call on hedging grounds. At spot reference: 14.1476 levels, we continue to uphold the same strategy as the underlying moves are foreseen to sense upside risks, a deep in the money call with very strong delta would most likely to move in tandem with the underlying moves.

Most importantly, 3m ITM calls are trading just 2.5% more than NPV, which is reasonable. Courtesy: Ore & Commerzbank

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -67 levels (which is bearish), while articulating (at 11:37 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges