The fears of a recession with weakening yields, massive losses on the stock markets, concerns about a government shutdown that could be on the cards today if the Senate is awkward, and another minister throwing in the towel and leaving the Trump administration – all events that are eroding confidence in the dollar at present. Therefore, it is likely to start into the Christmas period on the back foot.

While the drop of USDJPY 1Y vol below 8.0 even as macro markets were buffeted by a near-recessionary trifecta of yield curve flattening, credit spreads widening and sell- off in equities over the past two months has not escaped investors’ attention. 8.0 is not a line in the sand for 1Y yen vol by any stretch; we are through this year’s January lows, and the mid-2014 trough of 7.0 looms as the next major target, beyond which there is still substantial room to fall to re-test pre-GFC levels in the 6s. It is difficult to argue with option prices steadily softening when spot is stuck in a tight 112-114 range and delivering 2-2.5 pts. below implieds.

There is also a case to be made that the ongoing softness in yen realized vols can continue longer than some anticipate, since the propensity of the yen to rally in market downturns is being dampened by cyclically wide US – Japan interest rate differentials that we reckon are fuelling above-average investment outflows and reduction in FX hedge ratios of traditionally well-hedged foreign bond purchases. Anecdotal evidence suggests that such realized vol drags are being exacerbated by drip supply of vega from Japanese importers who are reloading / adding to USD-buying FX hedges with embedded short optionality on downticks in USDJPY spot.

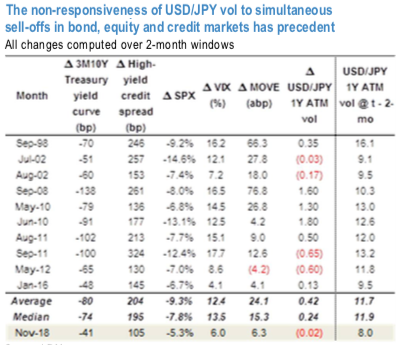

Finally, the insensitivity of yen vols to recent macro developments is not without historical precedent.

The above chart shortlists a handful of months that experienced risk-off moves in yield curves, credit spreads and SPX over the past 25 years equal to or greater than that of the past two months, and shows that 4 out of the 10 episodes before this year saw yen vol fall rather than rise in response to macro risk-off triggers, though admittedly all from initial levels well north of the current 8%. Courtesy: JPM

Currency Strength Index:FxWirePro's hourly JPY spot index is flashing at 83 levels (which is bullish), hourly USD spot index was at -5 (neutral) while articulating at (13:30 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts