We maintain long term bearish trend stance, while short term upswings could also to be utilized by below option strategy. Although some abrupt price recoveries that we've been seeing from every now and then, monthly chart still signals us the medium to long term bearish trend.

Currency Hedging Strategy: NZD/JPY Short Put Ladder

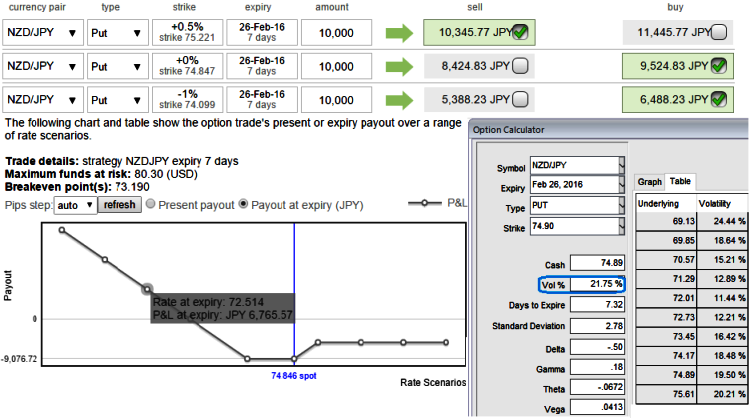

What does it do with current trend: Since the pair is holding stronger supports at 79.478, the short put ladder is an unrestricted return with partial risk bearing strategy that is deployed because in addition to the puzzling uptrend in short term and downtrend in long-term, we think that the NZDJPY would also perceive significant volatility in the near term.

Short Put Ladder Spread profits in all 3 directions; When the pair goes upwards (strongly or moderately), remains stagnant or goes downwards strongly. Indeed, the Short Put Ladder Spread has made profitable 4 out of 5 possible outcomes which make its probability of profit extremely high.

With current spot FX at 74.864 levels and ATM IVs 21.75%, the strategy takes care of long term basis hedging motives, as per our predictions of upswings upon strong stiff support at 74.478 in near term better to go short in 3D (0.5%) ITM put option with positive theta that is likely to yield certain returns as the pair keep rising a bit remain above 75.25, and longs on 2W ATM -0.49 delta put option and one more long position on 1M (-1%) OTM -0.39 delta put option for long term bearish stance.

Maximum returns are limited to the extent of initial credit received if the NZDJPY rallies above the upper breakeven point (BEP) but large unlimited profit can be achieved should the underlying exchange rate of NZDJPY makes a vivid downswings below the lower BEP.

FxWirePro: Stay hedged in NZD/JPY puzzling swings via short put ladder to monitor short term upswings and hedges downside risks

Friday, February 19, 2016 7:28 AM UTC

Editor's Picks

- Market Data

Most Popular