As the U.S. Federal Reserve has maintained status quo at its monetary policy meeting yesterday (funds rate at 1.00%) due to pauses to parse more economic data but may hint it is on track for an increase in June, bullion’s both spot and OTC markets have been highly active today.

Turning to silver more specifically, investor demand on the COMEX has primarily driven silver prices higher so far in 2017 with ETF demand and physical investment appearing lethargic from the 1Q data we have.

OTC updates:

Prices in bullion markets have tumbled, gold declined from the highs of $1,295 and silver from the peaks of $18.647 to the current $1,234 and $16.434 levels respectively.

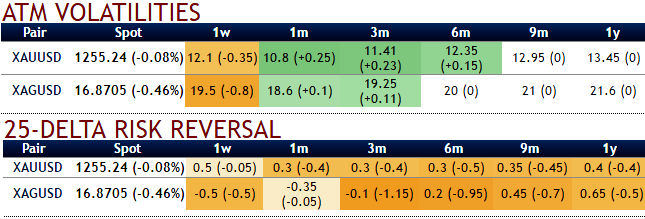

While hedging interests for downside risks are mounting as you could easily make out from the negative risk reversal numbers along with the corresponding noticeable spike in IVs of 1-3m tenors.

The implied volatilities of XAUUSD (gold) ATM contracts are spiking shy 10.5% and 11.41% of 1m and 3m tenors respectively, while above 18.5% and 19.25% for XAGUSD (silver) ATM contracts of 1m and 3m tenors respectively, while the spot price in technical trend approaching near crucial juncture, falling below 7 & 21 DMAs with bearish crossover (refer above technical chart), but it seems the major trend has been in consolidation phase we foresee equal opportunity for both bulls and bears with option writers of deep OTM calls are on slight upper hand.

Hedging Framework:

3-Way Options straddle versus OTM call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute:

At spot reference: 16.474 an ounce, initiate long in XAGUSD 2M at the money +0.51 delta call, go long 2M at the money -0.49 delta put and simultaneously, short 2w (1%) out of the money call with positive theta.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness