Dear NOK traders, don’t get excited prematurely. Only because the inflation target has suddenly been reached with the inflation data for January since Norges Bank lowered its inflation target from 2.5% to 2.0% does not mean that Norges Bank will hike its key rate imminently so that krone has to appreciate. At its January meeting, Norges Bank pointed out that “there was a continued need for an expansionary monetary policy“. After all capacity utilization remains below normal levels.

Moreover, Norges Bank forecast an inflation rate of 1.9% for 2018 and 1.8% for 2019 in its last monetary policy report. That means that Norges Bank had expected a notably lower inflation rate than the inflation target for some time anyway and had nonetheless signaled a first rate hike before year-end.

Norway continues to deliver better news with the underlying message being that activity data is improving and inflation is firming, which in combination with a lower inflation target should make the Norges Bank more amenable to a September rate hike. The message on stronger activity data was highlighted by the quarterly regional network this week which was constructive with broad-based improvement in tone, with the forward-looking component suggesting that GDP growth is set to increase to 3%ar by mid-year. On inflation, CPI was firmer than consensus, but in line with Norges Bank’s forecast on the headline.

Underlying inflation was indeed 0.3%pt below NB’s forecast but this was also the case in January, but our economists note that this didn’t trigger discomfort among the Executive Board members (Norway inflation in line with Norges Bank forecast, Brun-Aguerre). The Norges Bank meeting next week will be key next week.

We are looking for them to revise the rate path to show an earlier start of rate hikes (a small probability for 3Q) without a change in the steepness of the curve. The currency is close to NB’s December forecasts so that NOK has been the outperformer in G10 since the beginning of the year should not be a source of concern.

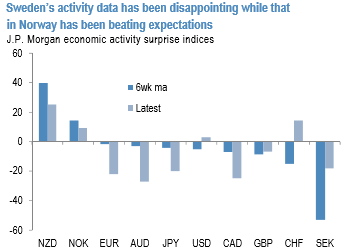

Our preference is to hold NOK longs tactically vs. SEK. While the medium-term view is constructive on SEK as well, the expectation is that the Norges Bank policy is more in flux in the near-term which should result in a mean reversion in FX valuations.

Moreover, the tactical cyclical backdrop is more favorable of NOK than of SEK with the 6-week moving average of our EASIs the most negative for SEK (refer above chart) but among the highest for NOK in G10. Courtesy: JPM

Trade tips:

Buy NOKSEK at spot levels. Marked at +1.28%.

Buy a 3m NOKSEK 1.066/1.092 call spread vs EURSEK 9.95 put for a net 20bp. (Spot refs 1.056 and 10.149). Marked at 7bp.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts