Prices remain under pressure, with the 1.30 psychological region and 1.2950 channel support below there already looming. US employment and the USD is likely to be the driver in the most part today, but a move back through 1.32 is needed to check this current trend lower and suggest a broader correction. While under, we still target a move towards 1.28, with the risks rising for a deeper move through there.

Long term, our studies suggest the bear trend that started back in 2007 at 2.1160 is in its last phase. Recent price action increases the chance that 1.1490 was a major long-term low.

Trade mechanism: Buy GBPUSD 6m bullish seagull strikes 1.25/1.38/1.41 Zero cost (Indicative, spot ref 1.3270).

This structure has almost no theta between the current spot and the 1.40 region during the four first months.

As it is zero cost and a very low theta means almost no convexity, it, therefore, behaves like a spot trade during this period in this region. The payoff, however, provides protection against a spot falls down to 1.25. The maximum profit amounts to USD3m if the traded notional is GBP100m per leg.

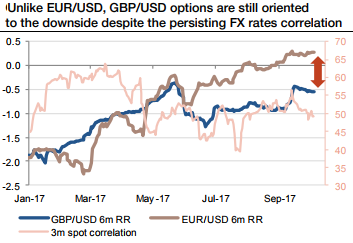

Options still skewed to downside Unlike EURUSD options, cable options are still pricing more implied volatility in the event of a lower currency (refer above graph).

The risk reversal curve remains fully skewed to the downside, especially for longer maturities. These diverging expectations are especially striking in a context whereby there is a strong correlation between EURUSD and GBPUSD.

We fundamentally view asymmetric odds in favour of the topside case, and this highlights the current cheapness of GBPUSD OTM calls. Even so, there remains a risk of a return to the low 1.20s and possibly a re-test of said spike lows in the next two years.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts