The euro slipped only moderately yesterday in reaction to the weaker than expected ifo index, with the data not actually being as weak as it might have seemed at first glance. In the current market environment of increased risk aversion the euro too seems to be in demand as a safe haven. The currencies that were hit quite hard instead in the G10 universe were the AUD (see below) and also the Scandinavian currencies which were affected by general uncertainty as well as increased economic risks in the euro zone.

Sterling on the other hand was amongst the winners yesterday. At present the currency is likely to be benefitting mainly from the recent fall in rate cut expectations. And indeed the stronger than expected PMI for January rekindles hopes of a certain economic recovery, which in turn reduces the need for monetary policy easing. It is still uncertain though to what extent the relief about the UK elections and an orderly Brexit will continue, as Brexit is far from over yet. Above all it is still unclear how close the trade relations between the UK and the rest of the EU will be once the transition period projected for year-end expires. As a result the uncertainty for businesses remains high. With this in mind the rise of the PMI might easily turn out to be a one-off.

The downside risks for Sterling thus remain considerable as GBP headroom is capped as investors have no clarity about the most important issue that will determine the economic consequences of Brexit - the future trade deal - albeit Johnson’s WA envisages a looser set of arrangements than May’s ill-fated deal.

We set the landing zone for cable in the event of a comfortable Conservative victory in the low 1.30s. Now we clearly didn’t reckon with the outpouring of speculative enthusiasm that would greet the delivery of an emphatic 80 seat Johnson majority, the largest for the Tories since Thatcher in 1987.

Nevertheless, the spike to 1.35 on election night proved very much an overshoot and GBP has since reverted to the low 1.30s, in line with our original projections. Despite Johnson’s surprisingly large majority, we see no basis to revise our GBP projections, these have been unchanged for quite a few months now.

Moreover, there is still the risk of an economic cliff-edge at the end of 2020 if Johnson honours his commitment not to extend the one-year transition.

Our assumption is that Brexit is the dominant issue for markets and so broader economic policies will be secondary for the exchange rate. GBP will likely take its directional cue from the read-through to Brexit whereas the size of the move will be augmented or moderated by the government’s broader policy platform.

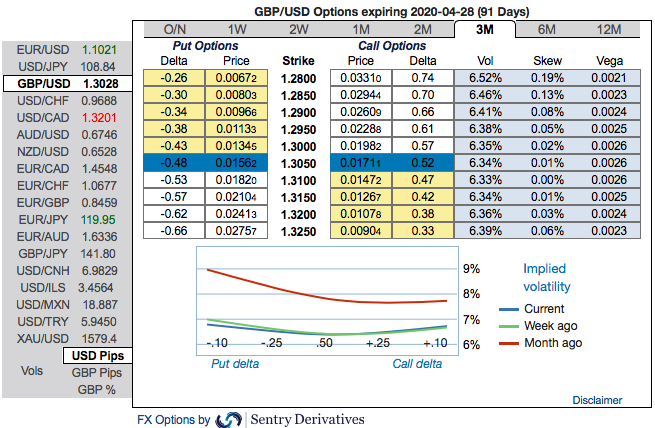

Strategy (Debit Put Spread): Contemplating above factors, wise to deploy diagonal options strategy by adding short sterling via a limited loss tail hedge: Stay short a 1M/3W GBPUSD put spread (1.33/1.29), spot reference: 1.3038 level.

The Rationale: Observe the 3m GBP skews that has stretched on both the sides, hedgers have shown interests on both OTM Calls and OTM Put options.

To substantiate the downside risk sentiment, risk reversal numbers have still been signalling bearish hedging sentiments in the long run amid minor bids for upside risks. Hence, we advocate the diagonal options strategy on both hedging and trading grounds. Courtesy: Sentry, JPM & Commerzbank

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields