Retail sales volumes MoM in UK surged by 1.9% in October, exceeding all expectations (CON 0.5%; LBCB 0.6%) after a modest 0.1% gain in September. Some strength in today’s report was expected, with advance indicators of retail activity – including the British Retail Consortium’s survey and weekly sales returns from John Lewis.

Looking ahead, headwinds to retail spending activity are likely to become more apparent over the course of 2017. The annual pace of retail price deflation slowed further in October, to 0.7% from 1.1% in September, and the outlook over the coming months is set to reflect sterling’s substantial post-referendum depreciation. A push higher in inflation will sap households’ purchasing power, which seems likely to weigh both on retail spending volumes, and consumer spending more broadly.

While unemployment claims in the UK is also improved from previous 4.9% to the current 4.8%.

OTC updates and Option strategy:

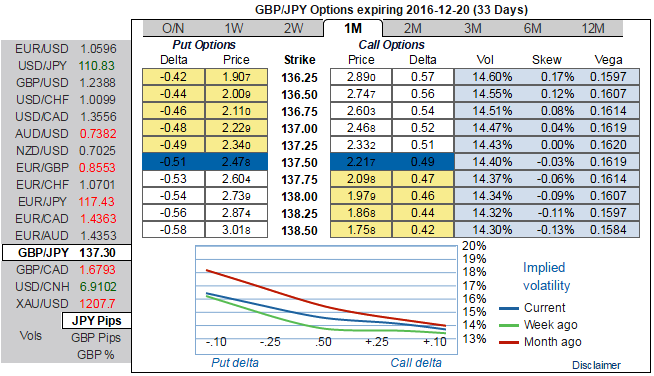

Ahead of quarterly GDP flashes in the UK that is scheduled for next week, 1m ATM IVs of GBPJPY are trading higher above 14% and positively skewed IVs suggest the OTC hedging interests in OTM put strikes, which means considering the current rallies and long term bearish trend we advocate below option strategy on hedging grounds.

Go long in 2 lots of 1m ATM -0.49 delta puts, while long in +0.51 delta put of the same expiry, See that payoff function the strategy likely to derive positive cashflows regardless of swings but more potential from 2 puts are more than 1 call.

The risk is Limited to the price paid to buy the options.

The reward is Unlimited till the expiry of the option.

Please note that the trader can still make money even if he was wrong – but the stock has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close