Risk reversals: Demand for GBP puts/USD calls have been consistently growing on fears of UK exit from the EU.

The likelihood of the significant 'brexit' will likely keep adding pressures on the UK currency day by day through the foreseeable future, while key events in the week ahead could force significant short-term volatility.

Leaving the European Union would be a "risky bet" for the UK, eight former US Treasury secretaries have said.

Crosby suggests it is possible that the government's pro-EU booklet sent to households across the UK might have driven the positive changes in campaign activity metrics.

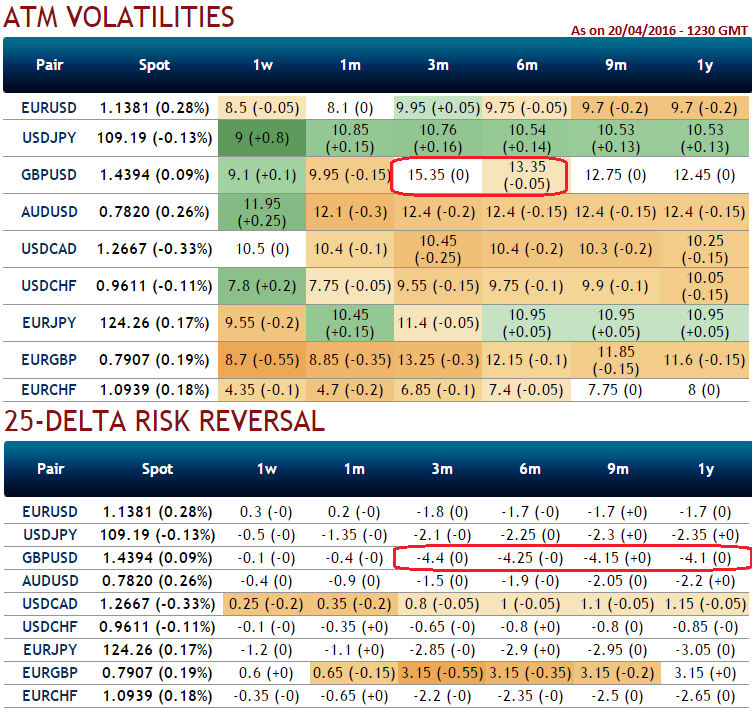

Simultaneously, 3M IVs are still trading at around 15.35%, which is highest level in last 70 months, IV touched 16.9% in May 2010, when Prime Minister Cameron was suffering coalition issues post-election.

With the adjustment to these IVs, risk reversals still indicates hedging sentiments for GBP are still bearish biased and next significant events that can have the major impact on GBPUSD would only be UK referendum (that is scheduled approximately 2 months from now) and BoE’s rising interest rate expectations which is again dependent on the Brexit issue.

Pound has currently snapped back from critical resistance against Dollar today at around 1.4383 area but price actions clearly suggests vulnerabilities prevail. This is quite evident if you can glance over OTC market arrangements, highest negative risk reversals for 3M tenors (-4.4) among G20 currency space.

Thus, we would still recommend a GBP/USD 3M risk reversal i/o 1Y as a generic hedge for Brexit risk. The ideal entry point is not ideal given the near doubling of the risk reversal since early October, but the bias is for further widening of the skew in 1H on slow-bleed demand for event protection.

As the risk reversals for 1W-1M expiries also indicate that the puts have been relatively expensive which means no significant strength in near term as well and as stated above traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022