Today it would be a hectic day for the Bank of England as it has to deliver two important policy decisions, MPC minutes and the Inflation Report. In between, the central bank will likely keep interest rates at 0.5%.

The test encounter that the MPC would likely to face in its inflation report and MPC minutes will be to present a more dovish view whilst invalidating market pricing of a rate cut risk.

The MPC's projections are conditioned on the market rate path and so would look as if varying with its rate communication that the subsequent policy would be a hike.

One way to reconcile this inconsistency would be for the MPC to predict a large overshoot of the inflation target at the three-year horizon which would then require a rate increase to bring inflation back to target.

However, the MPC is likely to face a tough communication challenge as its economic forecasts are conditioned on the market rate path that is downward over the course of this year whereas all the communication of the MPC has been to say that the next move in rates will be a hike.

While, we observe GBP with its major currency counterparts has been underperformer from last couple of trading sessions, GBPJPY dropped almost 2.25% from the highs of 175.011 to 171.011 (yesterday's lows), GBPUSD slid around 0.57% to the current flashes at 1.4577, GBPCAD dropped 1.37% during the early European trading sessions.

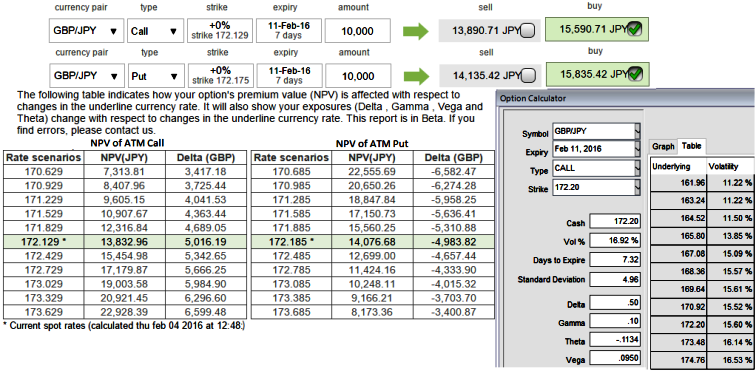

In GBP/JPY struggle we reckon it is good to stay short via credit call spreads as the ATM calls seem to be overpriced than ATM puts. As shown in the diagram, no much deviation in the instruments though, premiums of ATM calls are trading 12.70% more than NPV whereas puts are trading 12.49% more than NPV.

As we anticipate more downside potential in GBPJPY, we would like to IV advantage as well in constructing bear call spreads.

Hence, the recommendation is to go short in 1W (1%) ITM calls with positive theta value while longs in 1W ATM 0.51 delta calls.

This option trading strategy is employed when the options trader thinks that the price of the underlying asset will go down moderately in the near term.

The maximum returns achievable deploying this options strategy is the credit received upon entering the trade. The underlying pair needs to close below the strike price of the lower striking call sold at expiration date to reach the maximum returns, where both options would expire worthless.

FxWirePro: Sterling seems edgy against major as BoE goes hectic today – stay short in GBP/JPY via credit call spreads

Thursday, February 4, 2016 7:43 AM UTC

Editor's Picks

- Market Data

Most Popular