The Mexican peso has been one among the worst performers in the EMFX market during the two months. USDMXN today spiked back toward the 20.80 zone.

The pair rose from 20.60 to 20.77. It was trading at 20.75, up 0.72% for the day. From the level it had a year ago; USDMXN is up 20%.

Mexico registers trade surplus on higher goods and oil exports:

Mexico registered a $200 million trade surplus in November as international sales of manufactured goods posted double-digit gains and oil exports rose from a year before. The exports rose 11.1% to $34.47 billion, while imports increased 5.1% to $34.27 billion.

Oil exports rose 6.8% from a year before as state oil company Petróleos Mexicanos exported 1.273 million barrels a day of crude oil, compared with 1.179 million barrels a day in November 2015. The average price per barrel rose slightly to $38.20.

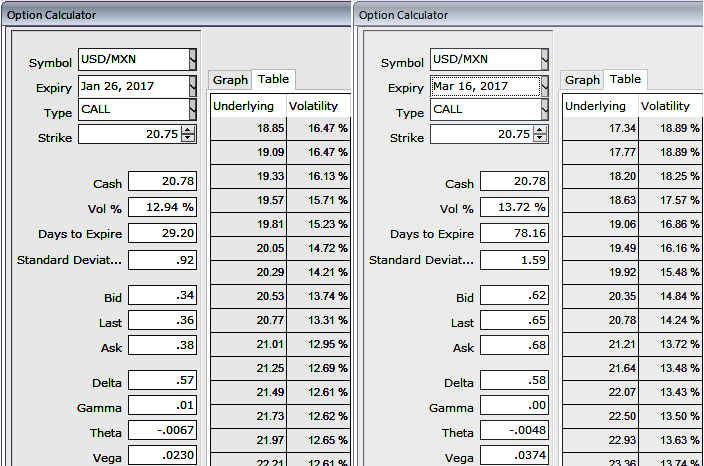

1m ATM IVs are trading a tad below 13% and trending above 13.7% for 3m tenors. So if you intend to hedge the bullish or bearish risks of USDMXN exposures via FX options, one should be mindfull of moneyness of these instruments.

For an instance, at-the-money delta option of call or put that has a strike price that is equal to the spot price of the underlying currency pair has the highest Gamma, Vega, and Theta which means their premium is the most sensitive to moves in either direction. They are particularly sensitive to Theta as the time to expiry approaches.

The Delta of ATM options are 50%, which means there is an even likelihood of expiring ITM or OTM.

Like OTM options, ATM options possess no intrinsic value and contain only time value which is greatly influenced by the volatility of the underlying spot FX and the passage of time.

Often, it is not easy to find an option with a strike price that is exactly equal to the market price of the underlying. Hence, close-to-the-money or near-the-money options are bought or sold instead.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch