Macro updates:

Japanese consumer confidence has reduced from previous 41.7 to the current 40.8.

Japanese current balance scheduled on Wednesday.

While, their machinery orders have shown improved numbers than forecasted -9.2% vs -11.8%, previous to which we had seen a jump from 4.2% to 15% in February over the previous period.

Machineries & machine tools order prints for current period is scheduled to be announced next week.

On the flip side, US retail sales, PPI are lined up for this week and building permits, CPI, FOMC minutes and unemployment claims for next week.

For today, Yen lost against dollar about 0.40% as USDJPY bounced a bit towards 108.751 from previous close at 108.312.

OTC Observation:

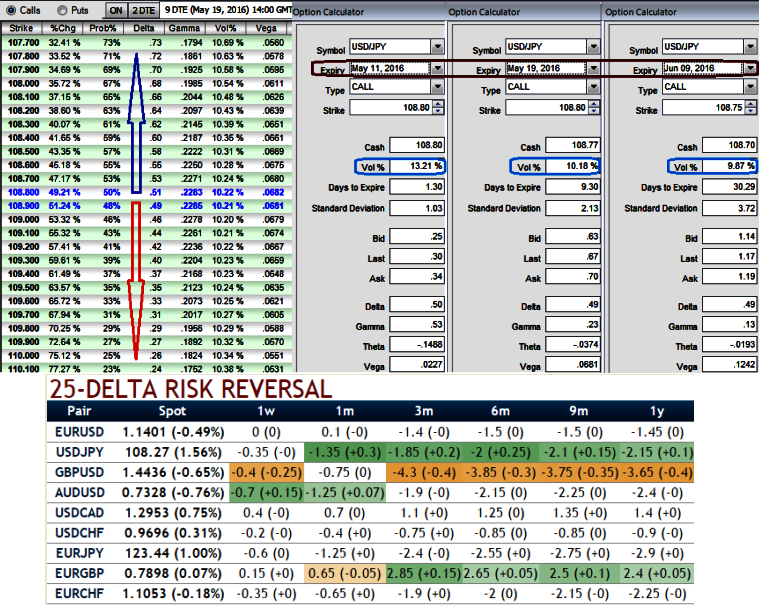

The current ATM implied volatility is spiking at 13.21% (of 1D expiry), reduced to 10.18% and 9.87% for 1W and 1M tenors respectively.

If you have to evaluate these vols and premiums with probabilistic figures in distinctive scenarios of OTM strikes, the options pricing seems reasonable, which means more likelihood of these puts expiring in the money.

You can observe the reducing hedging interest as current IVs of ATM contracts are collapsing below 9%, shrunk away after no significant economic data releases and especially after central bank policies from both euro and JPY sides.

But in contrast, as the delta risk reversals of this pair indicates still bearish neutral sentiments in FX OTC markets as there is no hedging interest seen in near terms (see for 1W expiries), this has again shown in favour of bearish interests as the progressive increase in negative numbers signify the traction for hedging sentiments for downside risks in both short and long term.

Execution:

Any potential downswings should be optimally utilized favouring major trend, so as to participate in that downtrend, weights in the portfolio should be doubled with ATM puts in order to give the leveraging effects. The profitability can be maximized for every shift towards downside and this is not the same on upside.

So, short ITM put with shorter expiry since implied volatility is inching higher when risk reversals are lesser comparatively to 1W expiries which is good for option writers ahead of data season, since the signals for long term downtrend have just begun, so the strategy goes this way, go long in 2 lots of ATM and OTM put with longer expiry (ex: 2M expiries) and simultaneously short 1W ITM puts with positive theta values.

Since risk reversal is in bearish neutral, any abrupt upswings could be capitalized to build in shorts with shorter expiries and delta long instruments for hedging downside risks have been favoured by acknowledging the stabilized implied volatility in 3M tenors.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX