In longer dated vols, this week indicated that Taiwanese life insurance companies were actively extending the maturity of their FX hedges, Bloomberg reports.

Whereas in the past they had focused primarily on 3-month swaps—the vast majority of which are executed onshore — anecdotal evidence from the region indicated a growing preference for 1-year and potentially longer tenors.

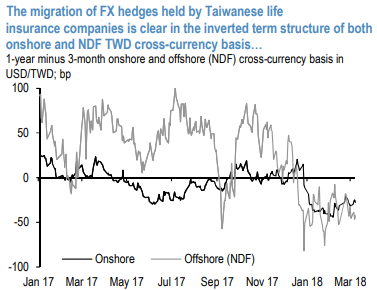

We can see evidence of this in FX forward pricing, where the term structure of both onshore and NDF cross-currency basis recently inverted (refer 1st chart).

Though not a regime shift by any means, such a change in hedging strategy is likely intended to mitigate the potential impact of Fed hikes on FX hedging costs. It is important to note, however, that with nearly 75% of our forecast for four hikes over the next year priced into the curve, barring a significant acceleration in Fed tightening we think 1-year maturities are unlikely to offer meaningful savings over rolling shorter-dated hedges.

Further, given more limited onshore liquidity in these points, they are exposed to the noticeably higher volatility exhibited by NDFs. In the meantime, given the relative slopes of the USD and TWD swap curves, carry on hedged foreign assets is likely to deteriorate as a greater fraction of their hedge book is pushed into longer tenors (refer 2nd chart). In fact, such a shift will likely make EUR-denominated assets—which already offer better relative value— look that more attractive by comparison. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge