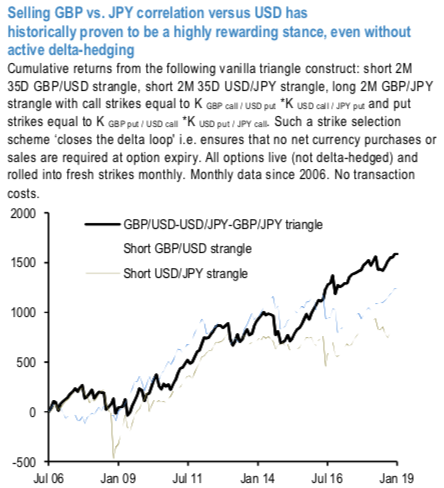

Last week, JPM has run us through into a GBP call/JPY put spread vs USD call/JPY put spread as a low premium expression of GBP bullishness against the backdrop of sharply lower odds of no-deal Brexit. We emphasize the other notable feature is the embedded short USD-correlation risk of the option spread aside from the directional exposure it provides, it benefits from de-coupling between GBPUSD and JPY/USD, in this instance via GBP strength and JPY weakness against the greenback – that has historically proven to be a highly rewarding stance to hold. Consider 1st chart that plots cumulative returns from selling GBP vs. JPY correlation via USD executed via a short GBPUSD – short USDJPY – long GBPJPY 2M 35D vanilla strangle triangle (all options live i.e. no delta-hedging). Steady return accumulation from a net option selling/premium collecting construct is not surprising in and of itself; the eye-catching aspect of the graphic is the relative absence of the large drawdowns that characterize short option strategies, especially around the GFC carnage.

For comparison, both the individual USD- legs in the 1st chart exhibits periodic large drawdowns that lead to markedly lower risk-return metrics over the sample period in question.

In the current Brexit context, the comforting takeaway is that our directional option spread structure is correctly positioned in terms of correlation risk. From a non-directional relative value standpoint, the option triangle in the 1st chart can also function as a viable low-touch theta collecting construct. In fact, USD-GBP-JPY ranks as one of the best correlation trios to consider within the universe of such trades within USD/G10 (2nd chart). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index has shown -123 (bearish), while USD is at 78 (bullish), and JPY is at -161 (bearish) while articulating at 10:56 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics