The richness of Yen risk-reversals has been a consistent feature of the FX option landscape and our commentary on the same in recent months, including in Outlook 2020 where fading the extended risk-reversal vs. ATM vol set-up was flagged a durable theta-earning theme over the year. The argument in favor of skew-selling is two-fold:

1) implied spot-vol correlation priced into risk-reversals is still rich despite some correction from 3Q’19 wides, since realized spot-vol correlation continues to be pressured by persistent unhedged Japanese outflows that have dampened the Yen’s traditionally acute (inverse) risk sensitivity; and

2) shorting skews takes the other side of relatively price- insensitive Japanese corporate and institutional hedging of US investments via risk-reversals rather than forwards over the past 12-18 months, the rationale for which has become considerably weaker over time as the US – Japan rate gap has narrowed and Yen skews have richened.

Our current trade expression to take advantage of this vol surface dislocation is a delta-hedged long ATM vs. short 25D 3M 1*1.5 ratio USDJPY put spread that intends to scalp smile theta with low/no outright vega exposure.

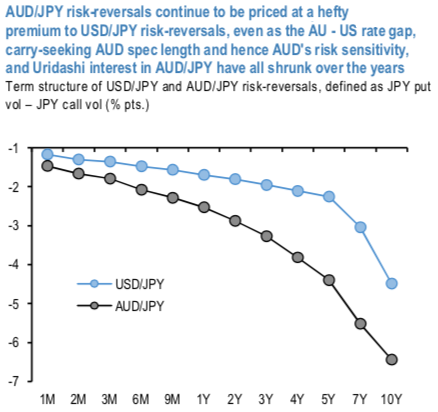

AUDJPY risk-reversals continue to be priced at a sizeable premium to USDJPY across expiries, most notably in longer maturities (2Y - 10Y, refer above chart). AUDJPY 5Y riskies for instance trade at a 0.8v premium (for JPY calls) over the arithmetic sum of 5Y AUDUSD and USDJPY riskies, which is not an unusual historical occurrence by any stretch but nonetheless suggests a lingering fear of GFC-like non-linearity / discontinuity in the behavior of the underlying spot. We are not convinced that this premium is justified for a number of reasons:

First, from a volatility perspective, AUD has become a pale shadow of the über-risk sensitive asset it once was as structural economic changes – in particular, the end of the Australian mining boom and its effects on debt-servicing capacity of strained household balance sheets – have ushered in idiosyncratic economic weakness and loosened AUD’s link to the global cycle. RBA’s counter-cyclical response to the growth slowdown of taking the cash rate down to all-time lows and thereby eliminating the traditionally high and positive AU - US yield gap has reinforced the decline in AUD’s risk beta, as carry-seeking speculative long positions have not only disappeared but in fact flipped short in anticipation secular economic weakness. The result is that GFC era boom-bust cycles of re-and de-leveraging of AUD longs are now history, and it is no longer unimaginable that bouts of risk-aversion could one day squeeze AUD higher should the initial condition going into such shocks be a large stock of short AUD positions. Courtesy: JPM

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close