Collect theta on AUDUSD and USDCAD vol ratio spreads traded via Gamma timing filter:

Risk premium harvesting via traditional straddle selling can be a challenging proposition when spot gyrations pose risk in front-end tenors and inverted curves challenge executing it in the back tenors. A close but a safer alternative is 1*N ratio call or put spreads (delta-hedged) on the rich side of the skew as a class of structures that can monetize risk premia in vol smiles. Placing the short notional overweight on the “risk-off” side, these structures sell risk-reversals resulting in quick collection of premium but are exposed to left tail and thus suitable only when there is no imminent risk from sell-offs.

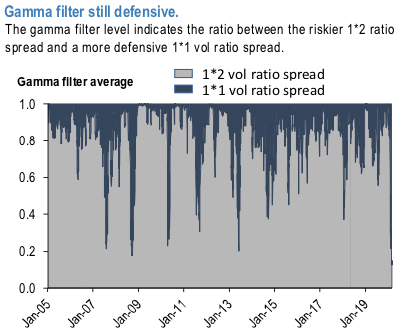

To solve the left tail issue we follow on the heels of our prior work on gamma trading filter (Total-return version of tactical filter allowing long Gamma trades) and utilize the filter in vol ratio spreads trading. The model relies on a set of common global indicators and along it currency specific variables that assess level of risk-aversion in the broad markets. We use the gamma timing filter to determine the notionals split between 1*2 vega ratio spreads and M/N (market neutral) ratio spread. The G10 average filter signal as given in the 1st chart is always within (0,1) range. The value of e.g. 0.75 means that 75% of the notional goes toward 1*2 and 25% into M/N risk ratio structure.

The historical average has been around 87-88% across currencies. The switching methodology is admittedly crude and could be optimized for different splitting formula, introduce thresholds, and/or optimize choice of structures. The long-term backtest in 2nd chart shows a clear benefit from utilizing the filtering methodology, with the volatility of returns materially improved as the max drawdown is cut by almost 50%.

One intuitive way for screening for the currencies with the most favorable backdrop for 1*2 vol spreads is to look at the following: a) medium-term performance, e.g. 3-year Sharpe, and b) current pricing of the 1*2 structures expressed as 1-y zscore of skew / ATM vol ratio.

Among the USD pairs at the current markets, the high beta G10 AUD, NZD and CAD screen the most attractively (the upper right quadrant in 3rd chart) thanks to the elevated skew vols, but the gamma filtering strongly suggests to express the structures via 1*1 vol ratio spreads rather than the more aggressive 1*2s. Courtesy: JPM

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data