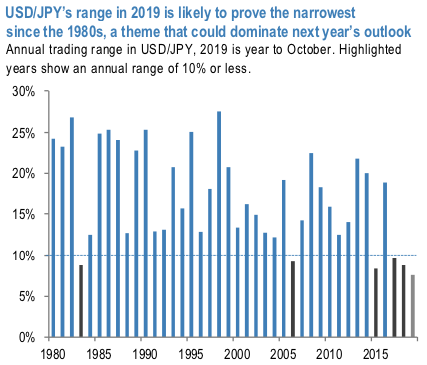

USDJPY’s range in 2019 is likely to prove the tightest since the 1980s, a theme that should dominate next year’s outlook too. Indeed, assuming USDJPY remains within its 2019 range thus far (104.10-112.40), this year’s range will be just 7.6% from peak to trough, the tightest since 1980. Trading ranges of 10% or less have been historically somewhat rare over the past few decades, so to have three consecutive years with USDJPY in such a narrow range is all the more unusual; USDJPY has been confined to a rough 105-115 range for three years now (refer 1st chart). We see three factors behind this trend.

First, a declining Japan-US inflation differential suggests a fundamentally narrower path for USDJPY. Assuming the long-term level of exchange rates is influenced by inflation rate differentials, USDJPY’s tendency to trend toward Yen appreciation reflects the unsurprising fact that US inflation has on average been higher than that of Japan. However, this differential has narrowed substantially, from around 2.8%-pts on average from 2000 to 2012, to just 1.0%-pt. from 2013, the year that “Abenomics” began to dominate Japan’s macroeconomic narrative (refer 2nd chart). This narrowing in the differential reflects an both increase in Japan’s average CPI rate over the same period (from -0.3%y/y to + 0.5%) as well as a decline in US inflation (+2.5%y/y to + 1.5%).

Second, the Yen is used less frequently as a short-term funding currency, implying lower potential for either sharp JPY weakness, or rapid JPY appreciation going forward. USD and JPY are both funding currencies in a broad sense: they are sold when investors become more risk-oriented, and bought back when sentiment deteriorates. In particular, since the mid-2000s, attention has been focused on Japan’s extremely low interest rates, incentivizing a higher degree of JPY sales during risk on episodes. On the other hand, pressure to repurchase JPY when risk aversion became stronger had also increased. As a result, although USD and JPY tended to move in the same direction, when both weakened, JPY tended to weaken even more, and vice versa. This dynamic had previously widened USDJPY’s trading range, particularly during extreme swings in risk sentiment.

But a confluence of dynamics suggest that large USDJPY swings on shifts in risk sentiment could be a thing of the past: EUR, not JPY, now looks better suited as a funding currency. Since March 2016, when the ECB reduced the deposit facility interest rate to -0.4%, EUR has emerged as the preferred short-term carry trade funding currency over JPY. Indeed, data released by the BoJ showing inter-office assets of foreign bank branches in Japan (a proxy for short JPY positions held by foreigners) also suggests that overseas investors’ short JPY positions are significantly lower than those in 2007 (refer 3rd chart).

Third, a step up in foreign investment by Japanese companies and investors has contributed to net JPY selling, in contrast to the past. In 2019, Japanese corporates’ direct investment and Japanese investors’ foreign securities investment stepped up, a point we have noted throughout the year. Given limited investment opportunities in Japan and anemic domestic yields, high levels of outward investment are likely to continue in 2020.

Contemplating the major trend that has been range-bounded (oscillating between 1.1425 and 1.0025 levels), and low IVs (implied vols) environment, it is wise to deploy strangle short strategy. USDJPY displays the least IVs for 1m tenors among the G7 FX-bloc (refer 4th chart) and the low vol regime is most likely to persist on the eve of festive season.

Hence, short (0.5%) out-of-the-money call and (0.5%) out-of-the-money put options of 1m tenor. The strategy can be executed at the net credit and certain yields would be derived in the form of initial premium received as long as the underlying spot FX remains between OTM strikes on the expiration. Courtesy: JPM & Saxobank

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One