Ahead of FED and RBNZ’s monetary policies that are scheduled today, NZDUSD speculators began paring extreme short positions, signalling NZD upside potential near-term. However, there is major event risk to navigate during the next week.

NZD is the preferred high-beta short within G10 gamut at present as it’s the only DM economy where the market prices a realistic chance of rate cuts over the coming year (around 10bp is priced by mid-19).

NZD is no longer expensive in outright terms (the REER is in line with a long-term average), that being said it is quite a bit more expensive than large parts of EM yet vulnerable to the same pressure from tighter US monetary policy with the additional kicker of course that NZD is now negative carry. The prevailing NZDUSD spot prices have been gaining upside traction which seems to be momentary, hence, we reckon that this is the right time to capitalize on upswings to enter into the better entry points and deploy ITM put options.

The catalyst for the reduction in short positions has been the improved mood in risky asset markets over the past two weeks (e.g. equities higher, US dollar lower). Recently announced strong NZ GDP data will add to arguments for exiting shorts, and we would not be surprised to see the NZD trading at 0.6725 during the week ahead.

OTC Outlook and Options Strategy (NZDUSD):

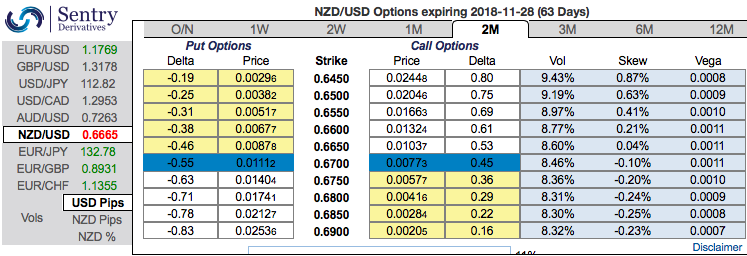

Most importantly, OTC market hedging sentiments still favor bears as the positively skewed IVs of 2m tenors signify the hedgers’ interests for downside risks. The bids have stretched for OTM put strikes upto 0.6450 levels (above nutshell).

Accordingly, we advocate 2m (1%) in the money -0.79 delta put options, the rationale for choosing such derivative instrument is that the deep in the money call with a very strong delta would move in tandem with the underlying move. Deep in the money call with a very strong delta will move in tandem with the underlying.

Considering ongoing price rallies of kiwi dollar, it is wise to capitalize on such deceptive rallies and execute below options strategy:

Add longs in 2 lots of 2m (1%) in the money delta put options and short 2w (1%) out of the money put options.Thereby, the strategy addresses both upswings that are prevailing in short run and bearish risks in the long run by delta longs.

Currency Strength Index: FxWirePro's hourly NZD is inching at 21 (which is mildly bullish), USD spot index is flashing at 143 levels (which is bullish), while articulating (at 11:01 GMT). For more details on the index, please refer below weblink:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays