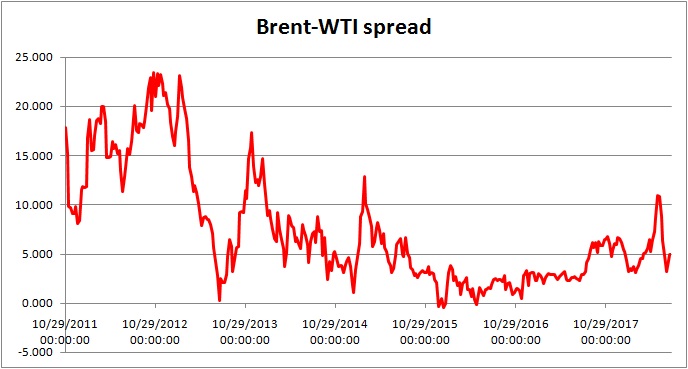

After reaching a whopping $10.9 per barrel in May, the Brent-WTI spread declined sharply after the OPEC meeting, where participants agreed to increase production, declined to $3.2 per barrel in June. The spread is currently trading at $5 per barrel.

Geopolitical tensions in the Middle East:

- Though all the parties have agreed to an election and national reconciliation process, the continuing crisis in Libya has led to production decrease to the tune of 400,000 barrels per day, according to the June monthly OPEC report.

- Iraq has also fallen into political chaos in recent weeks as protests against the government and years of economic stagnation, and the impact on oil production is to be reflected in July report.

- But most importantly, U.S. sanctions looming over Iran, of which, the first tranche would go live in August and the rest by the end of the year, is destabilizing the region.

- Iran has threatened that if its oil supplies, which is around 2.5 million barrels per day, is blocked by the United States then it would respond by halting exports from the Gulf countries by blocking the narrow bottleneck in the Persian Gulf, known as the Strait of Hormuz, where the channel is just 54 km wide in places. The threat is significant as almost a third of global sea-borne crude passes through the channel.

- In addition to that, just yesterday, Saudi Arabia announced that it would halt the passing of crude through the Red Sea channel, which is at the opposite side of the Middle East compared to the Strait of Hormuz. The move came in response to a Houthi rebels attack from Yemen on two Saudi oil tankers in the red Sea channel near the bottleneck in the channel, which known as the Gulf of Aden.

- The troubles in Syria, and as well as the tensions between Israelis and Palestinians also contribute to the geopolitical instability.

Trade idea:

- We expect the Brent-WTI spread to widen further if the geopolitical tensions in the Middle East intensify and if the United States moves to halt Iranian crude oil shipments.

- However, there exists a distinct possibility that any blockade of Iran crude or the Gulf crude could lead to an oversupply in the region and would ultimately lead to a sharp drop in the price of Brent, whereas the price of WTI could shot up due to a lack of supply from the Middle East. In the second case, the spread could even decline to as low as -$25 per barrel.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX